Financial advisers say the government’s recent pension reforms and the rise in life expectancy are fuelling demand for financial advice during retirement, according to a new study.

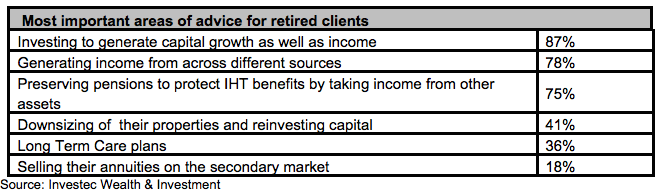

The survey by Investec Wealth & Investment found that 87% of advisers said their retired clients require ongoing support in generating capital growth as well as income.

Some 78% said that clients were looking to diversify their sources of retirement income and 74% were looking for guidance on how they can preserve their pension pots for inheritance tax purposes by taking income from other assets. Some 41% said it was due to property downsizing.

Given the need for pensioners to generate capital growth as well as income from portfolios, 94% of advisers believe they need to consider a longer term time investment horizon and three-quarters (77%) think they will need to accept a higher degree of volatility.

IW&I’s study highlights the increasing risks facing consumers looking to capitalise on recent pension freedoms. From the 250,000 plus payments worth £1.8 billion that were made to consumers from pension pots from April to June 2015, IFAs estimate that on average 38% of those consumers who took this course of action without professional advice were likely to have forgotten to reclaim income tax on their lump sum.

{desktop}{/desktop}{mobile}{/mobile}

Mark Stevens, head of intermediary services, Investec Wealth & Investment, said, “Traditionally the need for financial advice tended to taper down during retirement as most of the key decisions had already been made. Wide-ranging pension reforms that have ended compulsory annuities and enabled pension pots to be passed through the generations tax-free mean the need for advice has never been greater as clients come to terms with these new challenges.

“While pensioners now have considerably more room to manoeuvre, the risks involved in retirement planning strategies are commensurately higher. Faced with this additional complexity, we have seen a significant rise in the number of advisers seeking to partner with a discretionary fund manager to provide their retired clients with a long term risk-adjusted investment proposition.”

Research was conducted among 101 intermediaries in September 2015.