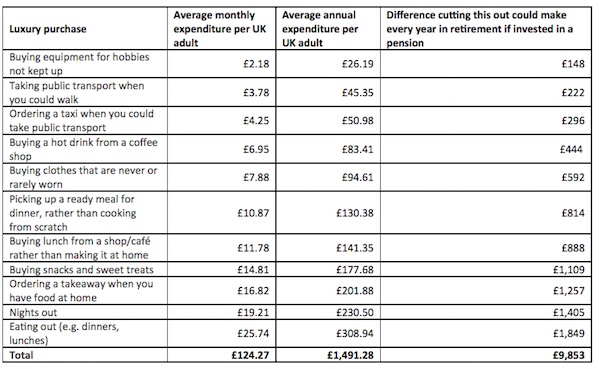

Research by Scottish Widows has revealed that people can save up to £9,853 more a year in retirement if they cut back on ‘little luxuries.’

The findings suggested that people spend £124 a month on small luxuries, such as takeaway meals, taxis, and clothes that they hardly wear, with 12% of people admitting that they do not keep track of their spending or have any idea how much each month is going towards non-essentials.

The figures are based on a 22-year-old planning to retire at 68 and putting aside £124 a month into a pension with a matching contribution from their employer. The estimates are derived using the Pensions Calculator on the Money Advice Service website. They include inflation in addition to assuming that contributions increase with earnings each year, as well as assuming no tax-free lump sum is taken at retirement.

However, the research also revealed that 32% of people said that they cannot afford to save any more than they already do.

Robert Cochran, retirement expert at Scottish Widows said: “While it would be unrealistic to suggest we live entirely without little luxuries, there is an important message about the need to ensure untracked spending today doesn’t harm our financial security tomorrow.

“Our Retirement Report shows almost 23 million people are failing to save adequately for retirement, and so there is no time like the present to make the first step towards positive change. It can also help build a longer term saving habit and make a real difference to quality of life in retirement.”

Despite many saying they are unable to save, the research showed that January is the month people want to start saving as three-fifths of people (62%) say they want to set a financial goal in 2018, whether spending less (28%) or saving more (45%).

A third (33%) of people spend less in January, cutting back by an average of £109.03 during the month and while 30% use this money to pay off debts, only 25% save some of it.

This research comes as it was also recently revealed by the Pensions and Lifetime Savings Association (PLSA) that 44% of millennials feel they need financial guidance as they are ‘confused’ about the savings landscape.

When it comes to prioritising savings, the research by the PLSA showed that the younger millennials made short-term savings with 34% saving for holidays, big ticket purchases (13%) or paying down debt (25%), while a third (33%) were prioritising house purchase.

More long-term goals come lower down the list. Saving to secure a desired lifestyle in retirement is a priority for just 20% of those aged 18-34 whereas it tops the list of savings priorities among those aged 35-54 (34%) and those aged 55 and over (50%).