Pension transfer values have hit a record high and two pension providers have warned that growing transfer values could spur a growth in pension scams.

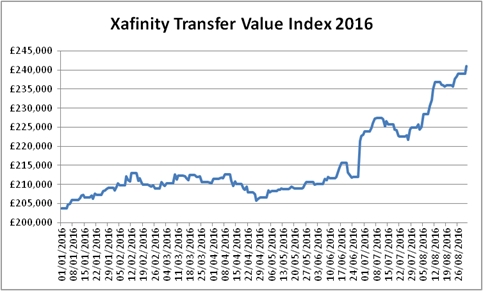

At the end of August the Xafinity Transfer Value Index stood at £241,000, an an increase of £16,000 (or 7%) over the month of August. The Transfer Value Index collated by the pension and employee benefits provider has increased by £37,000 (or 18%) since the start of 2016.

Xafinity says the growth in transfer values could encourage more scammers to target the transfer market.

Paul Darlow of Xafinity said: “An increase of 7% in just one month is extraordinary, and illustrates the eye-watering sums potentially now on offer to members of defined benefit pension schemes. I think there is a real risk that pension scammers will seek to exploit this by convincing unwary members to move their pension into bogus investments. We should all be on our guard to help protect members.”

The Xafinity Transfer Value Index tracks the transfer value that would be provided by an example DB scheme to a member aged 64 who is currently entitled to a pension of £10,000 each year starting at age 65 (and which increases each year in line with inflation).

Different schemes calculate transfer values in different ways. A given individual may therefore receive a transfer value from their scheme that is significantly different from that quoted by the Xafinity Transfer Value Index.

AJ Bell has echoed the call, following a Parliamentary debate on tackling financial scams. It has called for a ban on pensions ‘cold calling’ to stop firms targeting vulnerable people with significant transfer values. It warns that the pension freedoms have opened up a “gateway” to fraudsters.

AJ Bell senior analyst Tom Selby said: “The Government itself acknowledges older people are particularly vulnerable to fraudsters, and yet when it comes to taking preventative action on pension scams policymakers have been found wanting.

“In its response to today’s debate, the Government claims tackling scams is a ‘priority’. But it appears unwilling to consider banning cold calling for pensions even though this would act as a major deterrent to criminals targeting peoples’ retirement pots.

“The case for banning cold calling couldn’t be clearer – the pension freedoms, while providing welcome freedom and choice to savers, offer a gateway for fraudsters to steal money from people. If you stop people contacting pension savers in the first place, you cut off one of the heads of this many-headed snake.

“The Government should also review the regulation of SSASs, which are perfectly legitimate savings vehicles often abused by scammers, and consider reintroducing a sensible permitted investment list for SIPPs. It’s time the Government ditched mealy-mouthed platitudes and starts using the weapons at its disposal to take the fight to financial criminals.”