A survey has found that nearly half of younger retirees (44%) are withdrawing more than 10% of their pension savings each year, risking running out of money because they underestimate their lifespan.

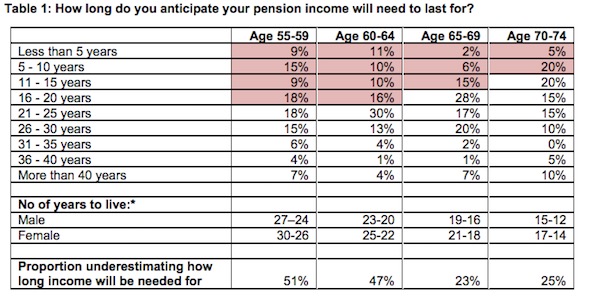

The survey by AJ Bell: ‘The Pension Freedoms Engagement Gap’ found that 51% of people in the 55-59 age bracket anticipated that their pension income would need to last for 20 years or less.

However, the latest ONS data released last week showed that men in this age bracket were expected to live for another 24 to 27 years on average and women were expected to live for another 26 to 30 years.

Similarly, 47% of people aged 60-64 anticipated that their pension income would need to last for 20 years or less, whereas men can expect to live for another 20-23 years and women another 22-25 years.

Younger retirees were more likely to underestimate how long their pension income would need to last for and are making larger, unsustainable withdrawals, says AJ Bell.

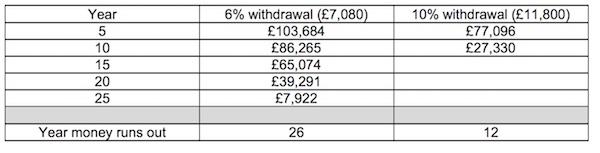

Based on the average level of pension savings of £118,000 withdrawals at 10% per annum, the average withdrawal, would only last for a maximum of 12 years. If the level of withdrawal was reduced to 6% of the starting value per annum, the money could last ‘a more comforting’ 26 years, the survey found.

Tom Selby, senior analyst at AJ Bell, said: “It seems that people using the pension freedoms are playing a life expectancy guessing game and are often coming up short.

“The evidence from our research suggests many people might be severely underestimating how long their pension income will need to last for and as a result the levels of withdrawals they are choosing to make look questionably high in many cases.

“It is important to note that nearly all of the people we questioned have other sources of income so they might be relying on these to supplement their pension income in future years. So we shouldn’t hit the panic button just yet. We are less than three years into the pension freedoms and so people are still getting used to the increased flexibility they have. This may calm down as flexible drawdown becomes the norm.

“However, the data does suggest that there is currently an engagement gap between people and their pensions and this is something that needs to be closely monitored as we move towards the third anniversary of the new rules next year. There is a clear need to understand the behaviour of people using the pension freedoms and ensure they have all the information, guidance and advice they need to make informed decisions.

“Anyone who is using the pension freedoms needs to have a realistic idea of how long their pension income might need to last for and what level of investment return they can hope to achieve. They can then work out how much they can withdraw each year without running out of money too early.

“Even then, the level of withdrawals should be reviewed regularly, something that far too few people are doing.”

AJ Bell surveyed 250 British adults aged over 55 who have been able to access their pension since April 2015.