As the latest inflation figures show a small drop today, Defaqto says that pensions who rely in part of their savings have been hardest hit by the low base rate.

The Office for National Statistics today announced the following inflation levels for November: Retail Prices Index (RPI): 5.2%; Consumer Prices Index (CPI): 4.8%.

According to independent financial research company Defaqto, the low base rate coupled with high inflation is not only impacting on people who receive interest on their savings annually, but also those who supplement their income by opting to receive this interest on a monthly basis.

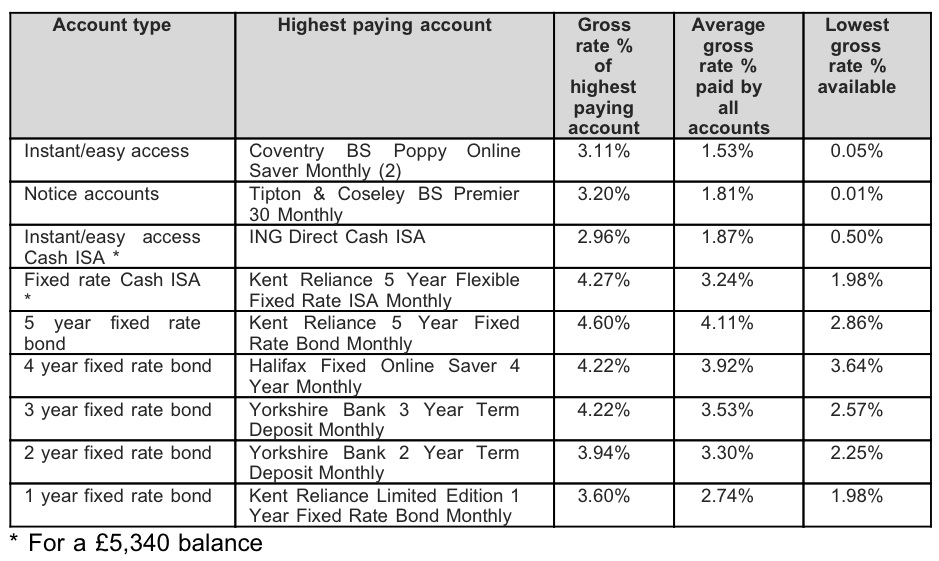

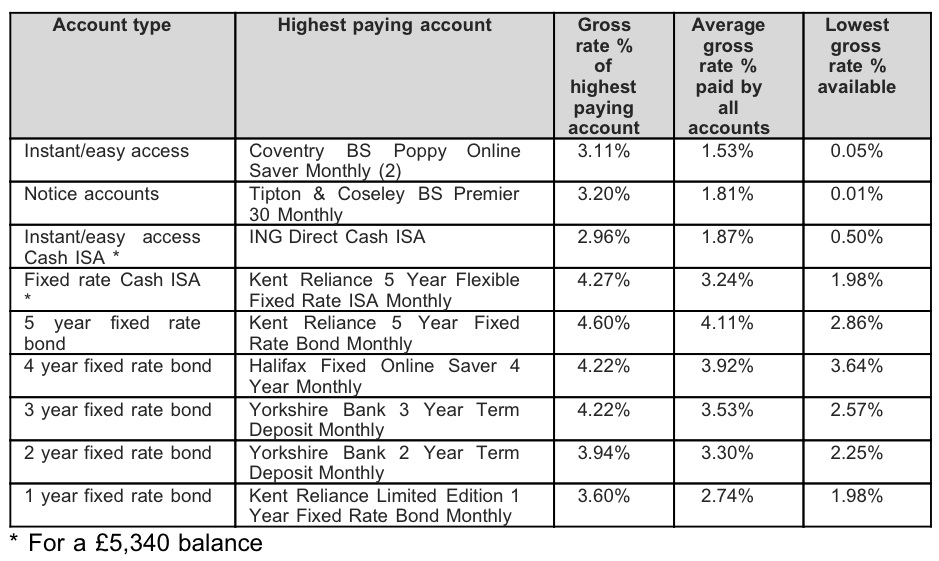

In particular, this will affect pensioners who are seeking to bolster their pension with interest from savings accounts. Defaqto data, below, highlights that the monthly interest rates currently available across all types of savings accounts fall below these required rates of return based on their gross annual equivalent interest rates, even for a non-taxpayer.

David Black, Defaqto’s Insight Analyst for Banking, said: “While all savers continue to suffer from inflation being very much higher than the bank base rate, those that rely on monthly interest from their savings accounts to supplement their income - notably pensioners - are also being badly affected. There is a massive difference between the best, average and lowest interest rates available among all types of accounts and this is equally true for those paying monthly interest.

“To get the best available returns, savers need to review their savings on a regular basis. They also need to take advantage of introductory bonuses and guaranteed minimum rates on savings accounts, and taxpayers should look to use their ISA allowance. Savers might also look at fixed rate bonds as a way of giving them a higher return over the longer-term, although they would need to be prepared to tie their money up for a fixed period.

“While there’s a glimmer of hope in that inflation is widely expected to fall in the short-term, the current situation only proves to amplify the importance of shopping around for the best deal with, for example, the highest paying easy access account paying over 60 times more monthly interest than its lowest paying counterpart.”