A third of employees are expected to opt out of auto-enrolment, according to Legal and General.

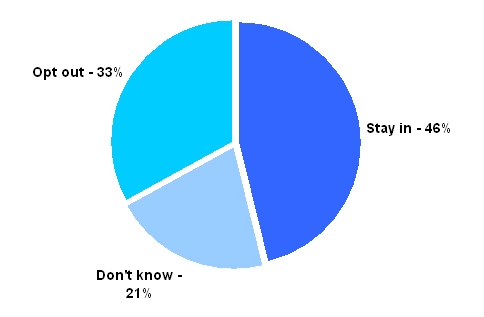

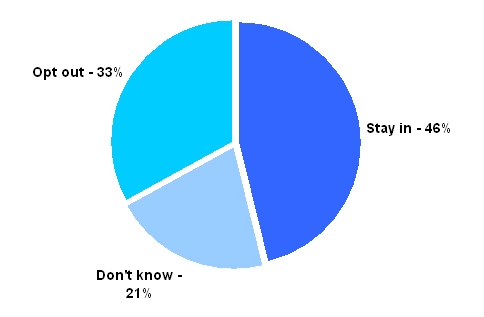

In a survey conducted by the firm, 46 per cent said they would stay in a company pension scheme while 33 per cent said they would opt out of the scheme.

The remaining 21 per cent were undecided.

The figures have only slightly improved on a survey done in 2007 when the auto-enrolment plan was first announced. Then 37 per cent of people said they were planning to opt out of the scheme.

However the opt-out figures are still high considering the large amount of publicity by the Department of Work and Pensions in the past four years to promote the scheme.

The group most likely to opt out of the scheme was the 22-30 age group who are the hardest to convince about pensions. Those in the 30-40 age group said it would provide them with a ‘nudge’ to join the company scheme while those in their 50-60s said they were more likely to rely on the state pension than a company scheme.

All respondents were not currently members of their company pension scheme.

Ian Mahoney, operations director of workplace savings at L&G, said: “Our research shows that the proportion of the workforce that are likely to opt out of the auto-enrolment process when it kick starts in October 2012 has not changed much in the last four years.

“We found that awareness among employees who are eligible for auto-enrolment is quite low with less than a third saying they had heard anything about it.”