The number of people aged 85 and over is set to double over the next 25 years to 3.2m, according to ONS projections out today.

The latest ONS population forecasts suggest that the number of people aged 85 and over will double from 1.6m in 2016 to 3.2m in 2041 as part of a long term trend towards an older population.

The government data provider also predicts that the total UK population will increase by 5.5% or 3.6m people over the next 10 years from 65.6m in mid-2016 to 69.2m in mid-2026, rising at a slightly lower rate than 2014 forecasts, but that older people will form a bigger proportion of the population.

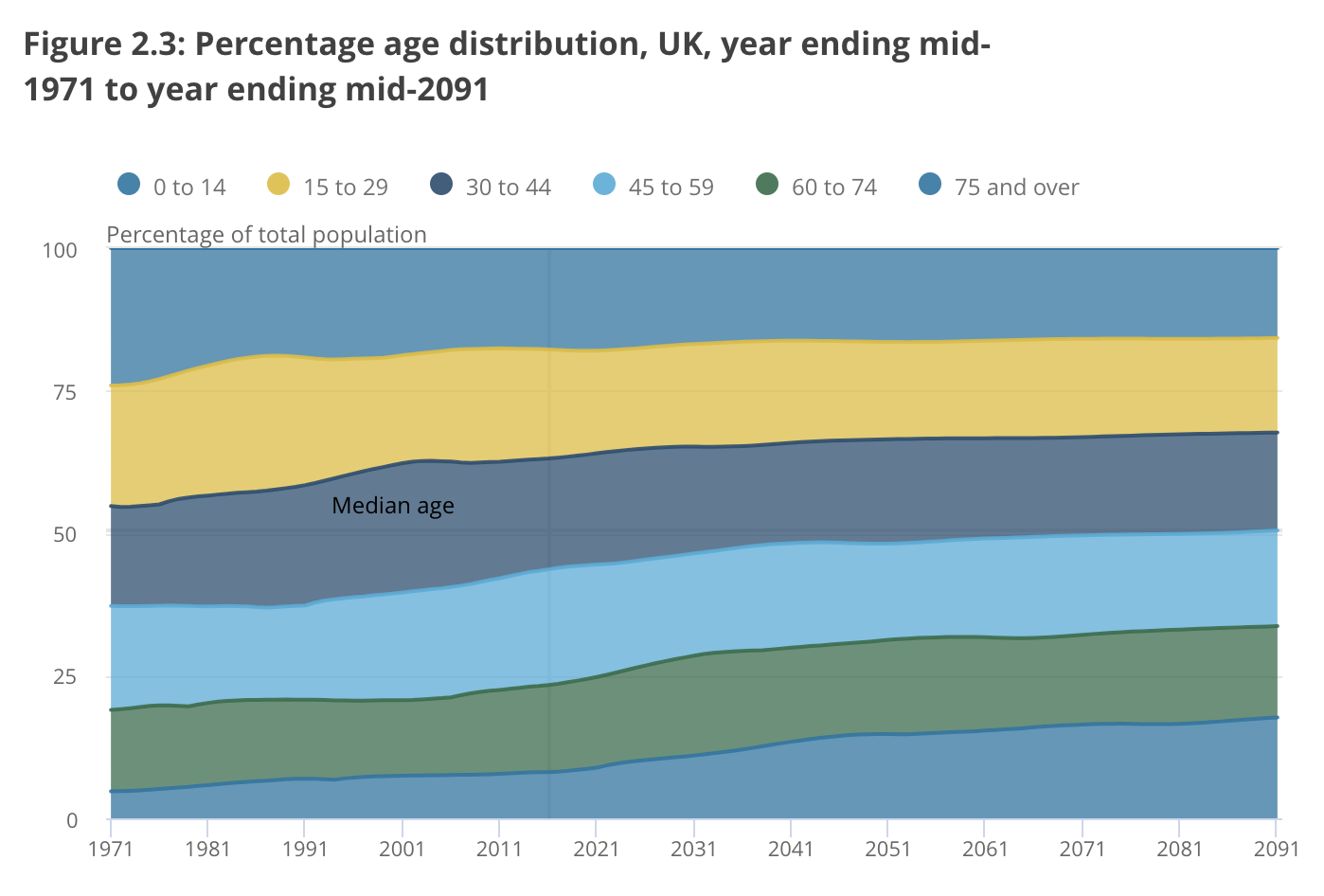

The increase in the older population will be evident over the next 10 years. The percentage aged 60 to 74 is projected to rise from 15.28% in 2016 to 16.6% by 2026. The percentage aged 75 and over is forecast to rise from 8.1% in 2016 to 10.2% by 2026.

In contrast, the pre-retirement population percentage aged 45-59 is forecast to decline from 20.29% in 2016 to 18.6% by 2026.

ONS has revised down slightly its projections for UK population growth due to lower assumptions about future levels of fertility and international migration and a slower rate of increase in life expectancy.

The forecast growth in life expectancy by 2041 has been reduced slightly for men from 84.3 to 83.4 and for women from 87.1 to 86.2.

Andrew Nash, spokesman for the Population Projections Unit at the ONS, said: “Over the period between mid-2016 and mid-2026 the population of the UK is projected to grow from 65.6 million to 69.2 million, reaching 70 million by mid-2029. England is projected to grow more quickly than the other UK nations.

“Over that period 54% of growth is projected to result directly from net international migration. The other 46% is because there will be more births than deaths. These projections suggest slower growth than the previous (2014-based) projections. This is because of lower assumptions about future levels of fertility and international migration, and an assumption of a slower rate of increase in life expectancy.”

Steven Cameron, pensions director at Aegon said: “Over the coming decades we’re likely to see profound changes to the way in which people work and save, with many more people transitioning gradually into full retirement and greater take up of part time work.”