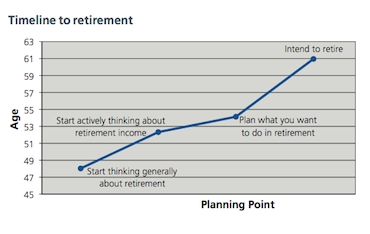

The average person does not start planning for their retirement until they are aged 52, according to Aviva.

This is despite actively thinking about four years earlier at age 48.

The figures come from the latest Aviva Real Retirement Report which questioned almost 12,000 over-55s.

Worryingly, over a third of people aged over-55 said they had still not made any practical preparation for retirement.

Unsurprisingly, 67 per cent say they wish they had started saving earlier.

The main reasons for not saving earlier were lack of money family commitments and being busy to think about it.

Savings have fallen by 27 per cent in the past year as rising inflation and falling income hits peoples’ pockets.

But the report states as well as monetary worries, there are serious psychological barriers which are stopping people saving.

Clive Bolton, ‘at retirement’ director at Aviva, said: “With income levels falling and inflation rising, it is going to make it difficult for some to maintain their standard of living and to secure a comfortable retirement income for themselves.

“However, there are also powerful psychological barriers to saving we must take into account in order to improve the retirement finances of future generations. Simply telling people to save more is not enough.”

Psychologist Dr David Lewis likened the process to a bereavement saying people first felt anger at having to leave their job then guilt at not preparing better and regret and reluctant acceptance of their situation.

He said: “In addition to these factors we also need to consider the MYGO factor. Standing for ‘My Eyeballs Glaze Over’ it describes how many people react to anything involving numbers.

“Finding figures tricky to understand, they put pension plans on a mental backburner until ‘in the mood’ to deal with them. Sadlly they never feel ‘in the mood’ so nothing gets done!”

• Want to receive a free weekly summary of the best news stories from our website? Just go to home page and submit your name and email address. If you are already logged in you will need to log out to see the e-newsletter sign up. You can then log in again.