Over £2.25bn was paid out by financial services firms in redress during the second half of 2011, mainly due to payment protection insurance, according to the Financial Services Authority.

Figures released today (28 March) show £2.1bn was paid out for PPI victims which included redress for victims whose claims were put on hold during the judicial review in the first half of 2011.

This is more than double the total figure in the first half of 2011 which totaled £409m.

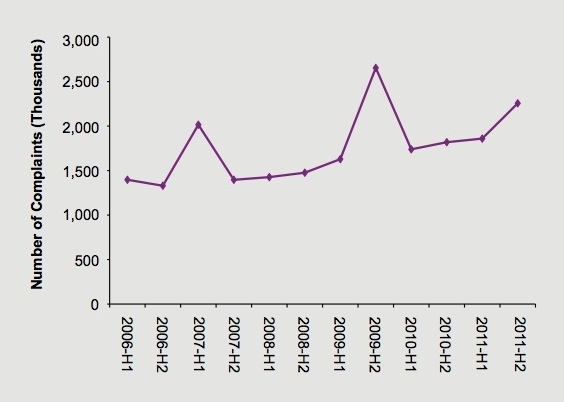

Complaints to financial services firms rose by 21 per cent to more than two million.

The total number of complaints received was 2,256,172 due to an 85 per cent rise in PPI complaints to 977,510.

This caused complaints to the ‘general insurance and pure protection’ sector to rise by 49 per cent to over a million.

PPI similarly caused complaints to the ‘advising, selling and arranging’ sector to increase by 69 per cent to over a million.

Some 92 per cent of these complaints were related to PPI mis-selling.

In contrast, the number of banking complaints fell to their lowest level since 2006 at 787,096. This is 13 per cent down on the figure a year ago.

Within this sector, complaints about current accounts, savings and other banking products fell although complaints about credit cards increased.

Some 60 per cent of complaints were upheld, up from 55 per cent in the first half of 2011 due to 69 per cent uphold rate for PPI complaints.