The Financial Conduct Authority has finalised new rules requiring listed firms to disclose progress against diversity targets.

The Personal Finance Society, the biggest professional body for Financial Planners and Paraplanners, has called for more ‘proportional’ regulation by the FCA under its new strategy to avoid killing off parts of the advice sector.

The FCA has issued 19 warnings on unauthorised and clone firms in the past 7 days, a rate of nearly 3 per day.

The Financial Conduct Authority will publish performance metrics for itself and the sector for the first time as it raises its annual funding requirement by 4.3%, according to the regulator’s business plan for the next three years.

The Pensions Regulator issued 20,555 compliance notices between July and December 2021, well down on the 35,087 issues for the previous six months.

The FCA has permanently revoked the regulatory permissions of IFA Frensham Wealth Ltd following the conviction of director Jon Frensham for a child sex offence.

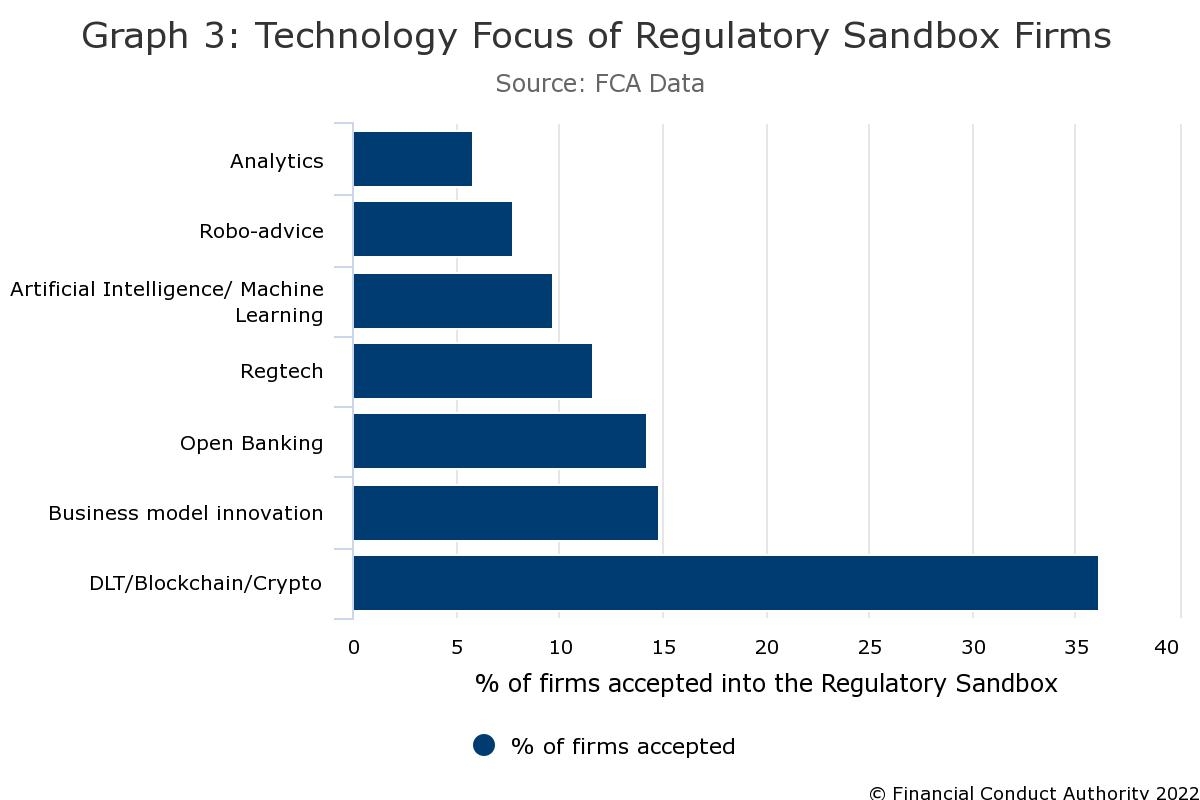

New figures from the FCA reveal that over 2,000 new fintech firms have applied for support since its Innovation Hub was opened in 2014.

The FCA, and its sister body the Payment Systems Regulator (PSR), are to lead a study into setting up a regulator of Open Banking.

The Financial Conduct Authority has published a list of risk areas for regulated firms to consider when dealing with crypto assets.

An Isle of Man-based wealth management and tax advice firm, AML Tax (UK) Limited, has been fined £150,000 for failing to provide HMRC with legally required information.

Page 28 of 82