CPI inflation dipped unexpectedly in August to 9.9% from 10.1% in July, according to the latest figures published by the ONS today.

A sharp fall in the price of petrol helped push down the rate of inflation.

Experts said the drop provided some relief for hard-pressed consumers but warned that CPI could still edge up in coming months.

The price of unleaded petrol has dropped from nearly £2 per litre at the start of the summer to around 165p/170p today.

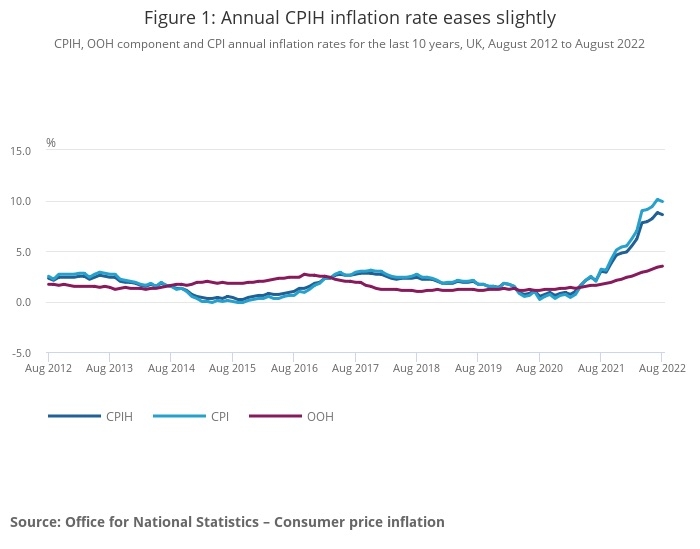

ONS said the sister CPIH index (Consumer Prices Index including owner occupiers’ housing costs) rose by 8.6% in the 12 months to August 2022, down from 8.8% in July. On a monthly basis, CPIH rose by 0.5% in August 2022, compared with a rise of 0.6% in August 2021.

On a monthly basis, CPI rose by 0.5% in August 2022, compared with a rise of 0.7% in August 2021.

ONS said a fall in motor fuel prices made the biggest downward contribution in inflation. The fall in CPI would have been bigger but increases in other items, including food prices and the cost of energy, kept the rate higher.

The largest contributions to the annual rate in August 2022 was from housing and household services, transport and food and non-alcoholic beverages, ONS said.

RPI, the older measure of inflation, was 12.3% in August, the same as July.

Richard Carter, head of fixed interest research at Quilter Cheviot, said: "In just a matter of weeks we will see utility bills soar ever higher as the new energy price cap comes in - albeit now capped at £2,500 following the introduction of Prime Minister Liz Truss’ energy plan, which is considerably lower than the previous prediction which sat at more than £3,000.

"With hope, the cap on energy bills may mean inflation is now close to peaking, though last month’s fall could likely be a fluke and we may see inflation climb further still in the months to come. While the energy plan may help, it comes at the cost of higher levels of borrowing and government spending which could encourage the Bank of England to hike rates even further than originally expected."

Sarah Coles, senior personal finance analyst, Hargreaves Lansdown, said: “Runaway inflation has paused for breath, after petrol prices pulled back in August. It feels like better news for anyone who has been wrestling with higher prices, but because petrol has driven the change, it offers little relief for those on lower incomes."

Nicholas Hyett, investment analyst at Wealth Club, said: "Today's moderation in inflation is welcome, but it may be just a short calm before the storm resumes."

Andrew Tully, technical director, Canada Life, said: “Today’s inflation numbers will do little to reassure households across the country who are struggling to come to terms with increased prices and higher bills, despite the Government’s recent proposal to limit energy bills for the next couple of years.

"It has to be said that the immediate outlook looks bleak, with The Bank of England predicting the peak of inflation to come later this year at around 13%. The peak, when it does come, will offer little respite when the tail of inflation is predicted to last well into next year and not come close to the target of around 2% for several years.

Tom Birkin, actuary at XPS Pensions Group, said: “For current pensioners, sustained periods of high inflation will compound the effects of pensions not keeping pace with rising prices. Pension schemes should explore options to support their members through this challenging period. Those who are able should consider whether they can provide financial support to their members, via additional increases to pensions above the caps in place.”

• Further reaction to the CPI figures may be added here. Please check back later.