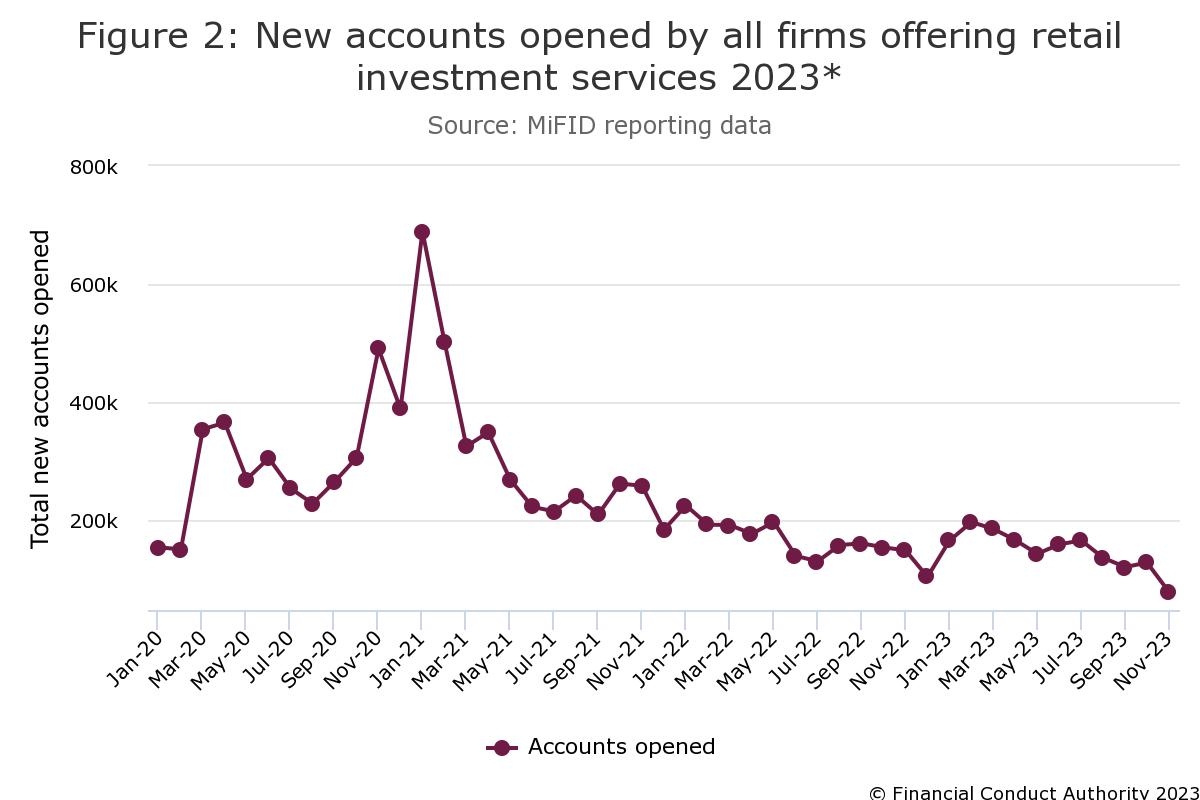

The number of retail investment accounts opened in the last three years has slumped to just over a tenth of its peak.

The figure is revealed in the latest Consumer Investments Strategy update from the FCA.

It showed a sharp decline in the number of new retail investment accounts opened, from a peak of 690,000 a month during Covid (January 2021) to only 80,000 last month (November).

Accounts were being opened at the rate of 155,000 a month in January 2020, pre-Covid.

During the pandemic they rose quickly with 366,000 accounts opened in April 2020 rising to 690,000 by January 2021 amid an investment boom as savers, with little to spend their money on, moved cash into investments.

Numbers have been steadily declining since but November was the first time they were recorded at less than 100,000 in the last three years.

The FCA said: “The market saw a slight contraction in the last 12 months, evidenced by the proportion of UK adults holding an investment declining. There has also been a slowdown in the number of new consumer investment accounts opening.”

Over the period the base rate has climbed to 5.25% while interest rates have similarly soared after more than a decade of being at record lows.

The FCA said: “Consumers face a very different environment now compared to when the Strategy was published in 2021, with the Bank of England base rate at its highest point since 2008. The rising cost-of-living continues to affect consumers and relatively unstable economic conditions continue to affect global financial markets which remain quite volatile.”

Elsewhere in the report the FCA said it was improving standards in the market, with 1 in 5 new consumer investment firm applications being withdrawn or rejected in the last 12 months compared to 1 in 7 in the previous 12 months.

It reported that just under £5m in consumer redress for unauthorised investment business was handed out in the year and 1,716 consumer alerts were published about unauthorised firms and individuals.

Its work addressing unsuitable financial promotions was stepped up, with firms required to amend or remove 8,582 promotions during 2022 with a further 9,052 promotions in the first three quarters of 2023, and an infographic produced for influencers.

Looking ahead the regulator said it will be kept busy implementing the Consumer Duty for closed products and services by July.

It will also be implementing the Financial Promotion Rules categorising cryptoassets as ‘Restricted Mass Market Investments’ and applying restrictions on how they can be marketed to UK consumers.

It also promised further work on its updated guidance for financial promotions on social media.