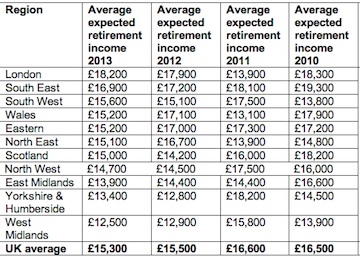

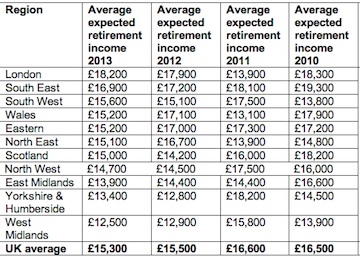

Expected retirement incomes have fallen for the second consecutive year to an average of £15,300 and are now 18 per cent lower than they were in 2008.

The company, a corporate member of the Institute of Financial Planning, has been surveying people entering retirement for the past six years.

Expected incomes have now fallen for the fourth time in five years and the effect has been worsened by rising inflation. Inflation has risen by 14.7 per cent since 2008 and someone who retired in 2012 would need an annual income of £21,400 to have the same buying power as someone retiring in 2008.

Those in the West Midlands had the worst expected income of only £12,500 while those in London had the most at £18,200.

{desktop}{/desktop}{mobile}{/mobile}

However, people living in London, North West, South West, Scotland and Yorkshire and Humberside expected to see their retirement incomes increase. Yorkshire and Humberside expected the biggest increase with a rise of £600 from £12,800 to £13,400.

Vince Smith Hughes, retirement expert at Prudential, said: "People entering retirement this year are continuing to feel the squeeze as their expected incomes have fallen for the fourth time in five years, to a new low. The continuing trend is even more concerning when you consider that rising inflation is eroding pensioners' spending power in real terms."

• Want to receive a free weekly summary of the best news stories from our website? Just go to home page and submit your name and email address. If you are already logged in you will need to log out to see the e-newsletter sign up. You can then log in again.