Individuals will need to plan ahead better in light of new government life expectancy figures, says AJ Bell, provider of pensions, investment and stockbroker services.

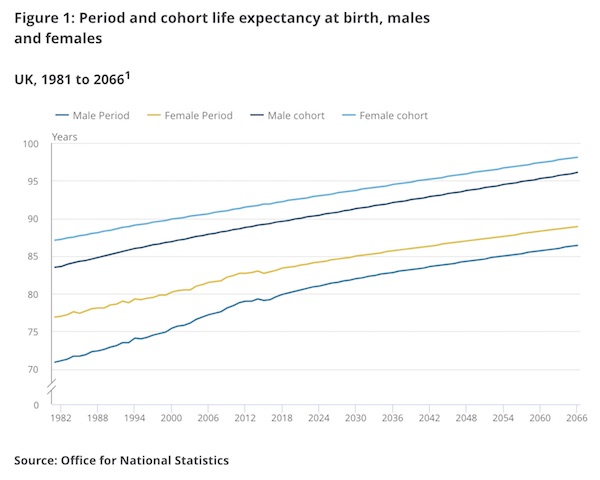

New figures released by the Office for National Statistics (ONS) today revealed that in 50 years time life expectancy at birth in the UK is projected to reach over 90 years for females and 87 years for males compared to 82.9 for females and 79.2 for males in 2016, a rise of about seven to eight years.

The figures also show that in the UK 44.2% of new born baby boys and 50% of new born baby girls in 2066 are projected to live to at least 100 years of age. In 2016 period life expectancy at birth was 79 years for males and 88 for females.

However, this increase in life expectancy numbers could mean individuals risk running out of money, according to the platform and Sipp provider.

Tom Selby, senior analyst at AJ Bell, urged savers to plan ahead: “Individuals need to consider the implications of rising life expectancy when planning for retirement. With large numbers of people making annual withdrawals of 10% or more, there is clearly a serious risk savers will run out of money in retirement.

“The UK state pension age hadn’t been changed at all since the modern welfare system was introduced in the 1940s. Given that life expectancy has increased almost constantly over that period – and is projected to continue its upward trajectory – this is unlikely to be the last state pension age hike we will see and future generations could have to wait until 70 and beyond to receive their state pension.”

Despite higher longevity projections, the report by the ONS also said that these projections show slower forecast rises than those seen in previous years.

However, financial provider Royal London claims that these figures have been ‘overdone’ although pension planners should not treat the projections as any less significant.

Steve Webb, director of policy at Royal London said: “Life expectancies are set to continue to rise dramatically over the coming decades. It is vitally important that policy makers and the pensions industry address these issues as a matter of urgency and do not assume that a few years of slower improvement constitute a long-term trend.

“Reports of the death of longevity improvements seem to have been rather overdone,” he concluded.