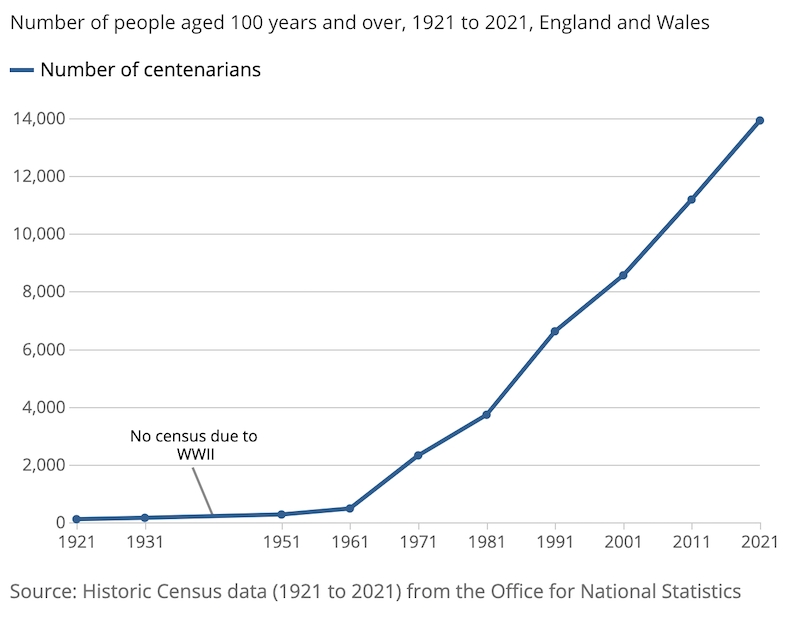

Fresh new challenges have been thrown up for retirement planning following the publication of new ONS statistics today showing that the number of centenarians living in England and Wales in 2021 climbed to the highest ever number ever recorded.

There were 13,924 centenarians in 2021, a 24.5% increase from a decade earlier in 2011.

The figure was a 127-fold increase on the 110 centenarians recorded a century ago in 1921 although they still only represent 0.2% of the population.

There was a total of 11,288 female and 2,636 male centenarians in England and Wales.

The latest predictions suggest almost one in five females born in 2021 can expect to live until age 100 along with more than 14% of boys.

That means increasing pressure on the state pension as well as having an enormous impact on people’s pension planning.

In 2010, the government forecast the number of centenarians living in the UK would reach 21,900 by 2020, and 37,600 by 2025.

Megan Rimmer, chartered financial planner at Quilter, said: “While today’s figures do show a marked increase, the government’s predictions hugely overestimated average life expectancy, illustrating just how difficult it is to accurately predict how long you will live.”

Life expectancy can vary hugely based on events outside of our control, she said. For example, it tends to increase in bursts corresponding to medical breakthroughs, but can be hindered by unpredictable events such as the Covid-19 pandemic.

This means everyone should plan their retirement around the very realistic possibility of living to 100, she added.

Helen Morrissey, head of retirement analysis at Hargreaves Lansdown said: “The prospect of living more than 30 years in retirement means we need to face up to the fact that we need to save much more into our pensions than many people think.”

She said a review of the state pension and the triple lock’s role within it is needed to give pensioners more certainty on what they can expect to receive and when to help them with their retirement planning.