Some 84 per cent of advisers do not think the re-labelling of the Investment Management Association sectors would help consumers understand risk, according to Skandia.

Earlier this year the IMA proposed changing its labels from Aggressive, Balanced and Cautious to A, B and C.

But a survey by Skandia found that the majority do not believe these changes would help consumers to understand the level of risk they are taking.

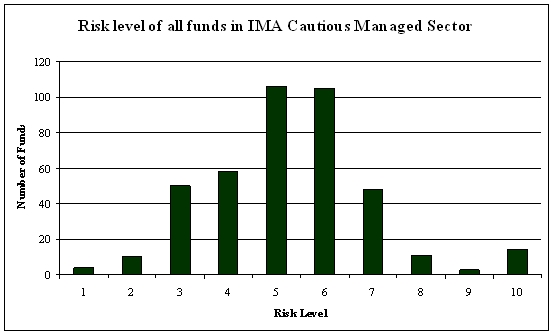

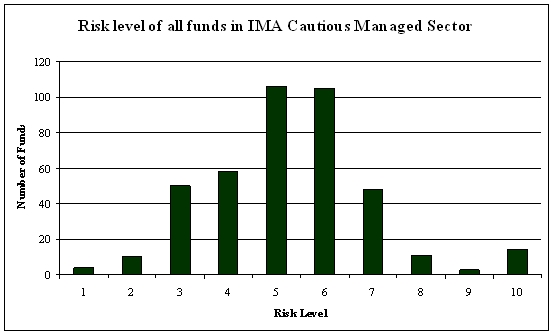

To indicate this, Skandia gave the example of the risk levels in the cautious sector.

Some 90 per cent or respondents thought that funds labelled as cautious were misleading as customers thought these had a risk level of around two or three.

In fact, most of the funds in the IMA cautious sector were rated at around five or six.

Research using Skandia’s managed fund analyser found that over 200 funds in the IMA Cautious Managed Sector were rated as having a five or six risk level.

This indicates there is a significant gap between what customers perceive to be the risk and what the actual risk level is.

Graham Bentley, head of proposition at Skandia, said: “It is worrying to see just how far separated perception and reality are from one another.

“Consumers may, quite rightly, assume their cautious fund is low risk and carry a risk score of just two or three out of 10. Yet unfortunately this is not the reality.”

• Want to receive a free weekly summary of the best news stories from our website? Just go to home page and submit your name and email address. If you are already logged in you will need to log out to see the e-newsletter sign up. You can then log in again.