Today, the Isle of Wight is the retirement "capital" of the UK, with 42% of its residents claiming state pension, followed by Bexhill and Battle in East Sussex.

In contrast to the coastal areas that make up Britain's current retirement hot spots, those areas with the fewest retirees are all urban. The London constituency of Poplar and Limehouse is the least popular for retirees with just 9% of its population claiming the state pension, followed by Glasgow North and London's Vauxhall (see tables below).

However, LV= says the stereotypical view of a quiet, 'put-your-feet up' retirement by the sea looks set to change, with the majority of those not yet retired predicting a major change to their retirment plans in terms of retirement locations.

Almost two thirds (57%) of Britons believe that by the time they stop working, the average retirement will be very different from what it is today.

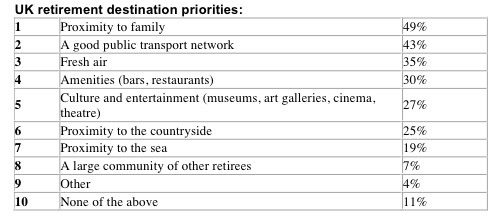

When listing their priorities for retirement, being close to amenities such as a good public transport network (43%), access to bars and restaurants (30%) and culture and entertainment (27%) all scored far higher than proximity to the sea (19%), or living in a community where there is a large number of other retirees (7%). Proximity to their family was the most important factor (49%) when considering where people might live in retirement.

Over half of people still working (56%) are looking forward to keeping themselves very active and trying new things in retirement. The majority of people (68%) want to continue to live independently in their own home, either alone or with their partner. However, the research also suggests a gradual move to more intergenerational living in retirement. Some 10% of today's 18-34 year olds would wish to live with their future extended family in retirement (including any children and grandchildren they may have), as opposed to 5% of UK pre-retirees over 55.

The research also indicates a rise in 'Golden Girls' style communal living, with 9% of 18-34 year olds wanting to relive their student days in a communal house, living with friends in retirement.

{desktop}{/desktop}{mobile}{/mobile}

Ray Chinn, LV= head of pensions said: "It's clear that when you ask people about what they want in retirement their aspirations tend to mirror more closely their lifestyle today, rather than one which we would typically associate with a pensioner. Regardless of how people feel when they actually reach retirement, to ensure that they can continue to enjoy their life to the full they need to have planned their finances accordingly.

"We would urge people to seek professional financial advice whether they are very close or a long way from retirement. Being aware of all the options available, such as enhanced annuities, drawdown or equity release, can make a significant difference to the lifestyle people are able to enjoy in retirement."