Platform provider Transact will cut its charges as of 1 April as price competition in the platform market intensifies.

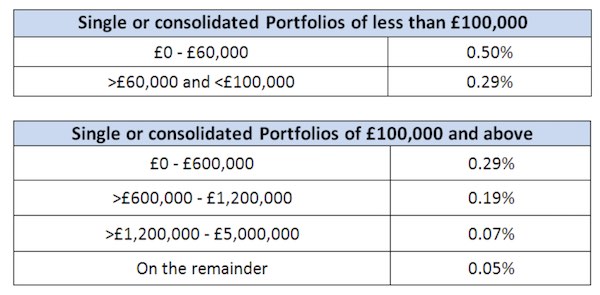

The price reductions include a decrease in the annual commission charge for all portfolios over £60,000, a reduction of the discount threshold from £120,000 to £100,000, and the introduction of a new lower pricing band for portfolios over £5m. The changes will apply the same annual commission charge to both cash and investment holdings.

Jonathan Gunby, chief development officer of Transact which has been considering floating on the stock market next year, said: “We have removed the differentiation between the charges for investment and cash, making price cuts in line with our responsible pricing approach.

“Successive price cuts have had a positive impact on our net flows and profitability while providing benefits to both advisers and their clients. Our funds under direction are now around £29bn and we are again passing on savings derived from our scale and specialisation in the platform market."

The new pricing structure will apply to new clients, who join the platform from April, as well as existing clients, 75% of whom will pay less, says Transact. These changes are Transact’s 11th price cut since 2008.

Transact recently announced the launch of a Lifetime ISA, making it one of a few providers to offer LISA. The launch of LISA will add to the platform provider’s exiting flexible ISAs and JISAs.

Transact says that advised clients can open a Transact LISA to start saving towards a first home or towards retirement, and receive the 25% government bonus that can be claimed on contributions.

The new wrapper can hold investments and cash, and Transact will accept new subscriptions and transfers from other ISA wrappers and ISA providers. Savers can add new subscriptions up to a maximum of £4,000 per annum, which will contribute to the overall ISA subscription limit for 2017/2018 of £20,000.