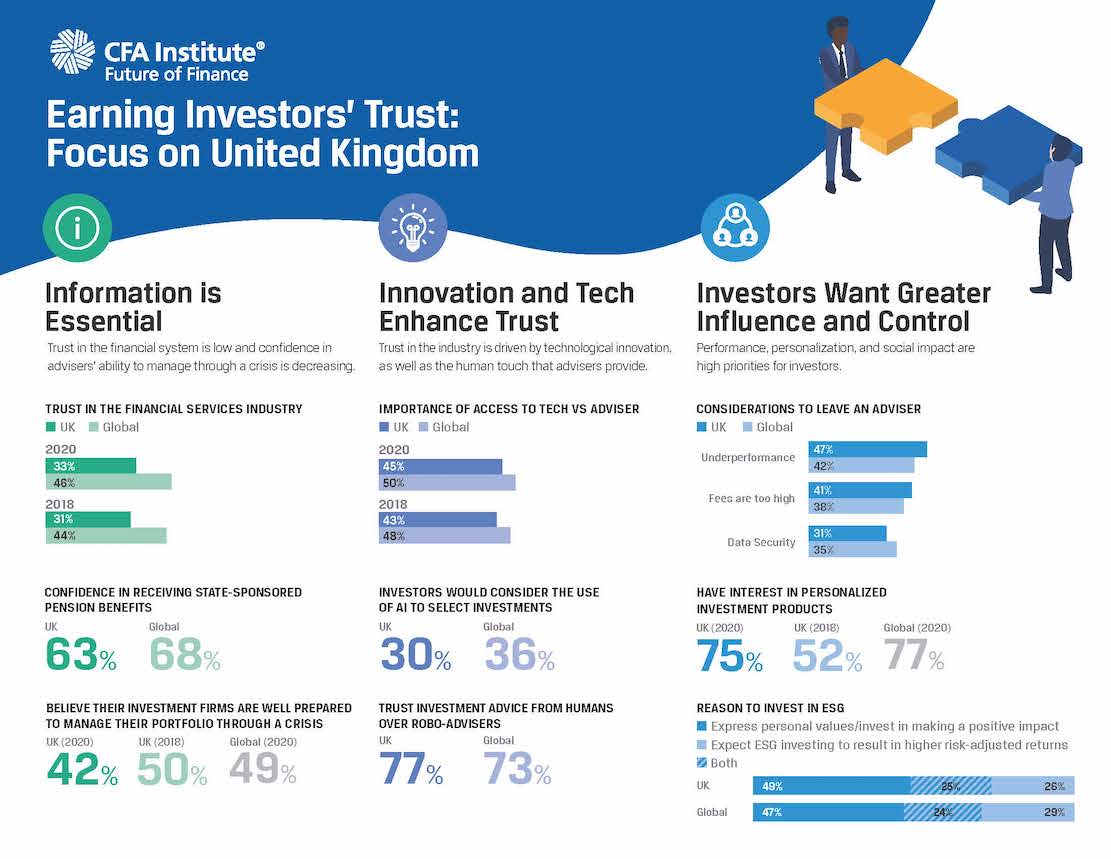

Only 33% of UK investors trust the financial services sector compared to 46% of global investors.

Additionally, UK investors’ confidence in the sector’s ability to manage through a crisis is decreasing.

The survey by the investment professionals’ body the CFA Institute found that only 42% of UK investors believes the investment sector can manage through a crisis compared with half in 2018. The global average is 49%.

The survey was conducted in November and December, before the outbreak of Coronavirus, and found the level of trust shown by UK investors was similar to a year earlier and among the lowest of 15 global markets surveyed.

The survey revealed that trust was the ‘number one’ factor globally for retail investors when hiring an adviser.

For institutional investors trust and performance were most valued.

The vast majority of UK investors - 77% - preferred human to robo-advisers, higher than the global average.

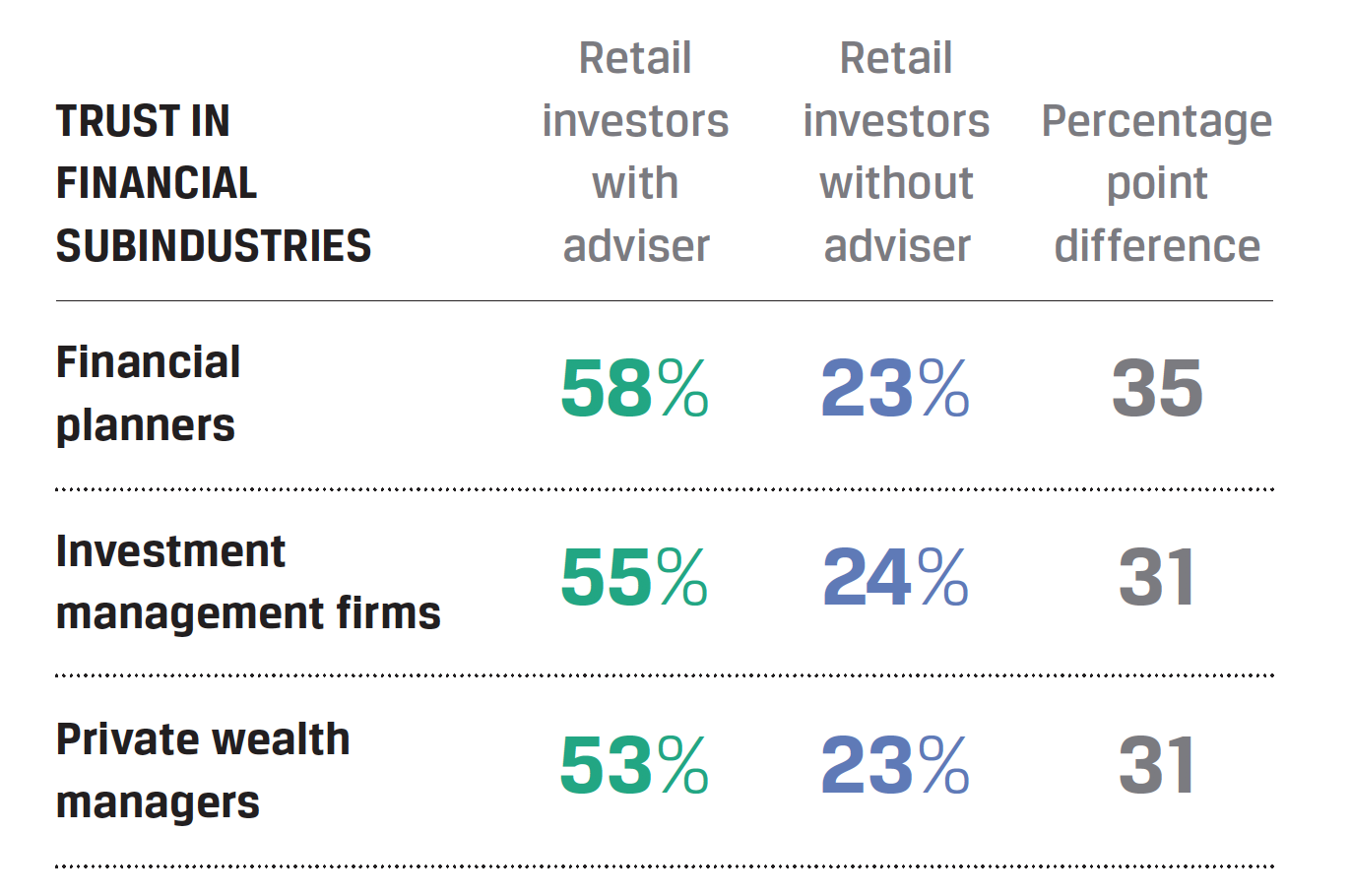

Globally, doctors, lawyers and accountants were all seen as more trustworthy than financial advisers, however Financial Planners did better than many other sectors with 58% of Financial Planner retail investors stating they would trust financial services compared to 23% without an adviser (see table).

Source: CFA Institute

The study - the fourth edition of the CFA survey ‘Earning Investors’ Trust’ - covered 4,000 retail and institutional investors in 15 markets worldwide, including 500 in the UK.

The CFA survey said the two significant components of trust were “credibility and professionalism.”

The survey suggests eight action steps organisations and professionals can take to build trust. These include having a strong brand identity, employing staff with recognised professional credentials, adopting industry codes, improving transparency on fees, using clear language and showcasing ongoing professional development.

Margaret Franklin, CFA President, and chief executive of the CFA Institute, said: “Fear and panic can obscure sound investment decision-making. In this climate, the need for trust in institutions and in the advisers who act on behalf of investors, as well as the financial system in which they operate, becomes starkly apparent.”

The survey found that in the UK:

• Personalised investment products are becoming more of a priority for UK investors, with 75% having an interest in this area (a 23% increase on 2018)

• 77% of UK investors trust advice from humans over robo-advisers (compared to a 73% global average).

• UK investors are less likely (30%) than the global average (36%) to consider using AI to make investments

Source: CFA Institute

Globally, of the 15 markets surveyed, retail investors in India reported the highest levels of trust in financial services at 87%, while Australia ranked last among the 15 markets, with only 24% of respondents saying they trust the industry.

Trust increased most in Hong Kong SAR, India, the UAE, and Brazil, and decreased most in Singapore and Australia.

• The online survey was conducted by Greenwich Associates on behalf of the CFA. Some 3,525 retail investors and 921 institutional investors were surveyed in October and November 2019. Retail investors were 25 or older with investable assets of at least US$100,000, except in India, where the minimum was 500,000 rupees. Institutional investors included individuals responsible for investment decisions with at least US$50 million in assets under management.