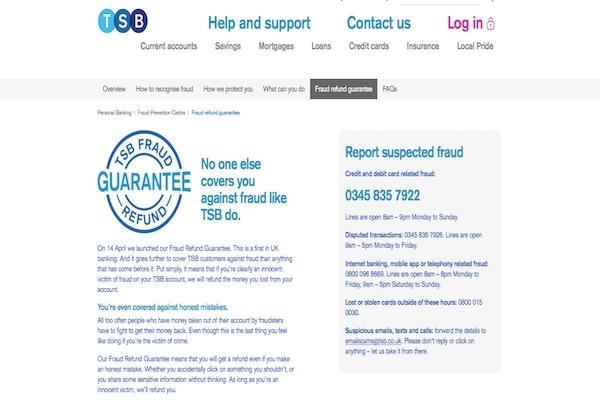

TSB says it is the first bank in the UK to offer a new fraud refund guarantee.

The firm says its new policy will “ensure the bank’s 5.2 million customers are protected if they are an innocent victim of fraud – whether it’s unauthorised transactions on their accounts or customers tricked into authorising payments to fraudsters”.

TSB says the new policy, which came into effect yesterday, marks “a significant step-change in banking”, where today customers are only refunded for fraud losses in limited circumstances.

In the future TSB’s customers will be refunded for any loss they have suffered from their account as a result of third-party fraud.

Bank fraud is a rapidly growing problem and has a devastating effect on consumers across the UK, TSB says.

As people are increasingly going digital and online shopping has doubled over the past five years, the propensity for fraud has also increased, as have the sophisticated means by which consumers are targeted – with one in four Britons falling victim to online fraud last year.

Statistics released by UK Finance showed that over £1.2bn was stolen by criminals committing bank fraud last year.

TSB executive chairman, Richard Meddings, said: “The vast majority of fraud claims across UK banking are from innocent victims of fraud, who have been targeted by criminals and organised gangs.

“However, all too often these customers must fight to be refunded and are not treated as victims of crime.

“We want to provide peace of mind to our customers, that’s why we’re proud to announce the TSB Fraud Refund Guarantee.

“If a TSB customer innocently suffers a fraud loss on their account after being targeted by a criminal, we’ll cover it.”