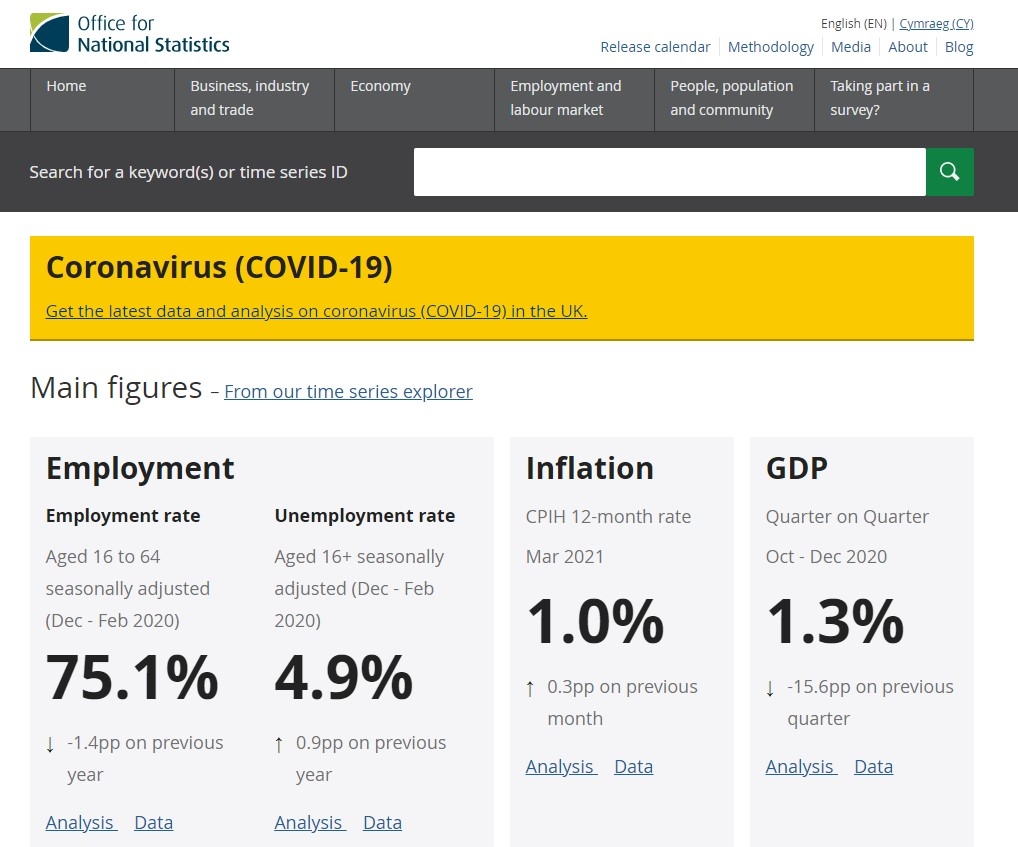

The UK economy saw zero growth in February following a surprise 0.4% jump in GDP growth in January, according to the latest figures from the Office for National Statistics (ONS).

Today’s figures showed that GDP growth was flat at 0% for the month.

A rise in construction activity was offset by strikes from teachers and civil servants in February, leaving the UK economy narrowly avoiding recession.

Three-month average GDP growth rose 0.1%.

Darren Morgan, director of economic statistics at the ONS, said: “The economy saw no growth in February overall. Construction grew strongly after a poor January, with increased repair work taking place. There was also a boost from retailing, with many shops having a buoyant month.

“These were offset by the effects of Civil Service and teachers’ strike action, which impacted the public sector, and unseasonably mild weather led to falls in the use of electricity and gas.”

The construction sector saw a growth of 2.4% but the UK services sector contracted by 0.1% and production fell by 0.2%.

Tom Hopkins, portfolio manager at BRI Wealth Management, said the latest figures demonstrate that a UK recession seems likely.

He said: “Although a recession has been avoided, for now at least, the UK economy remains in a troubling state. Today’s reading comes just days after the International Monetary Fund predicted that the UK economy will shrink this year, the worst performance among the G20 nations.

“The UK’s poor performance over the last 12 months is attributed to the rapid hikes in interest rates needed to bring inflation under control, and the country’s heavy dependence on natural gas for heating and electricity which has made Britain more vulnerable to global increases in the cost of fossil fuels. The cost of living is really hitting growth, and whilst headline CPI is slowly coming down, core inflation remains stubborn.

“Despite the government’s optimism on the UK avoiding a recession this year, the UK economy has been stagnating for some time, we think a mild recession is imminent.”