The FCA’s latest retirement income market data for 2022/23 published today has revealed that the money being withdrawn from pension pots is falling, dropping 5% to £43,199m from £45,638m in 2021/22.

However, slightly more pension pots were accessed for the first time, with the number climbing 4.9% from 705,661 to 739,535.

That suggests that while more people have been raiding their pension savings, as pension firms have been reporting, consumers have been taking out smaller amounts.

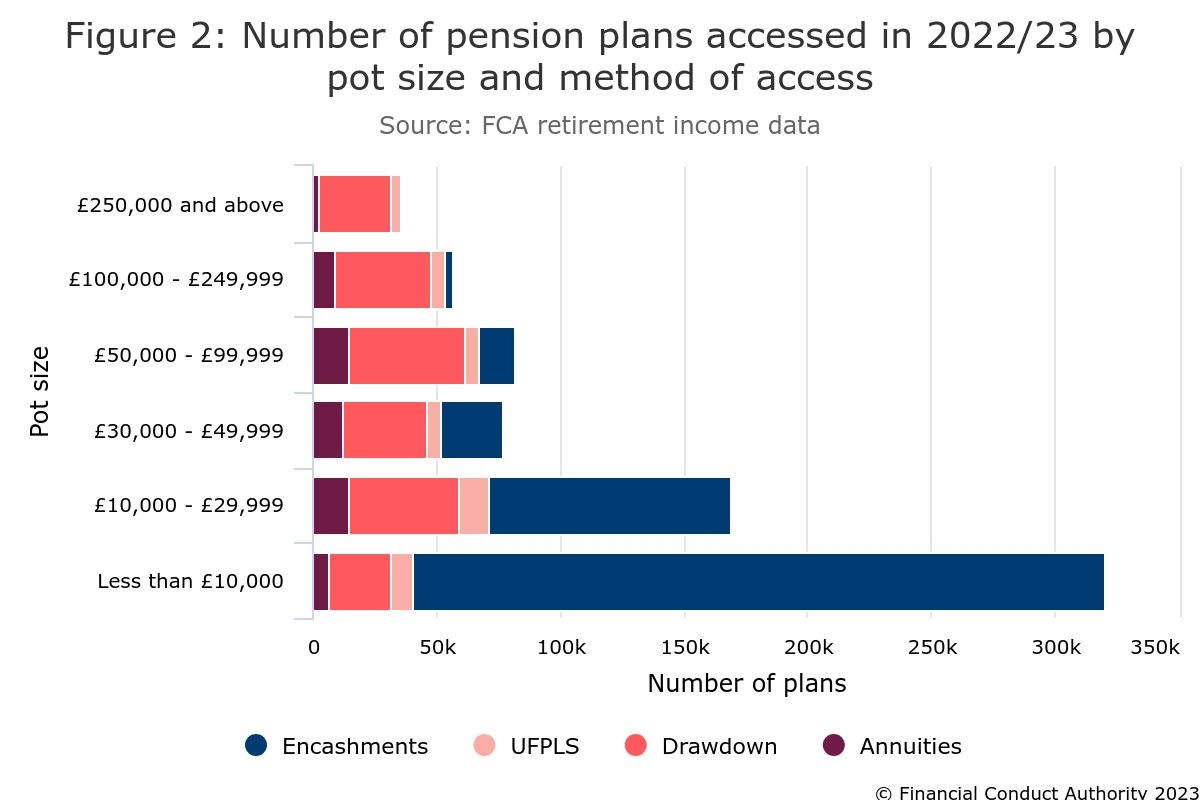

The new FCA figures backed that up by showing the majority of pension plans accessed were worth less than £10,000, most of which were taken as cash.

There were around 320,000 pots accessed worth less than £10,000, with 279,229 of them cashed in and only 6,397 taken as annuities.

Steve Webb, LCP partner and former Pensions Minister, said: “These figures highlight the fact that hundreds of thousands of people reach retirement each year with very small pension pots."

At the top end there were around 35,000 pension pots accessed worth £250,000 or more with the majority taken as drawdown. Some 29,332 were taken as drawdown, 3,800 as uncrystallised lump sum (UFPLS), just over 2,000 as annuities and just 407 as cash.

The figures showed that sales of annuities fell considerably, with the number of annuities purchased in 2022/23 being 59,163, down 13.6% from 68,514 in the previous year.

The popularity of annuities was higher among older people with 58% of annuities taken out by those aged between 55-74, and just 33% taken out by those aged under 55. Some 8% of annuities were taken out by those aged 75 or over.

Cashing in showed the opposite trend with 69% of encashments taken out by 55-64 year olds and just 28% by those aged between 65-74. Some 2% of encashments were by the over 75s and 1% by the under 55s.

The number of DB to DC transfers continued to fall, dropping 32% from 26,619 in 2021/22 to 18,073 in 2022/23. The trend showed a continued decline from the 30,596 in 2020/21.

Brian Nimmo, head of redress solutions at actuarial consultancy OAC, said: “Falling transfer values are likely to have accelerated the trend as pension savers increasingly see the risk in losing the value of the guarantees in a DB pension by transferring into a DC arrangement.

"A significant number of advisers have stopped advising on DB transfers too as they decided that increasing regulation makes it too risky for their business, and the FCA's 'polluter pays' reforms may accelerate that trend."