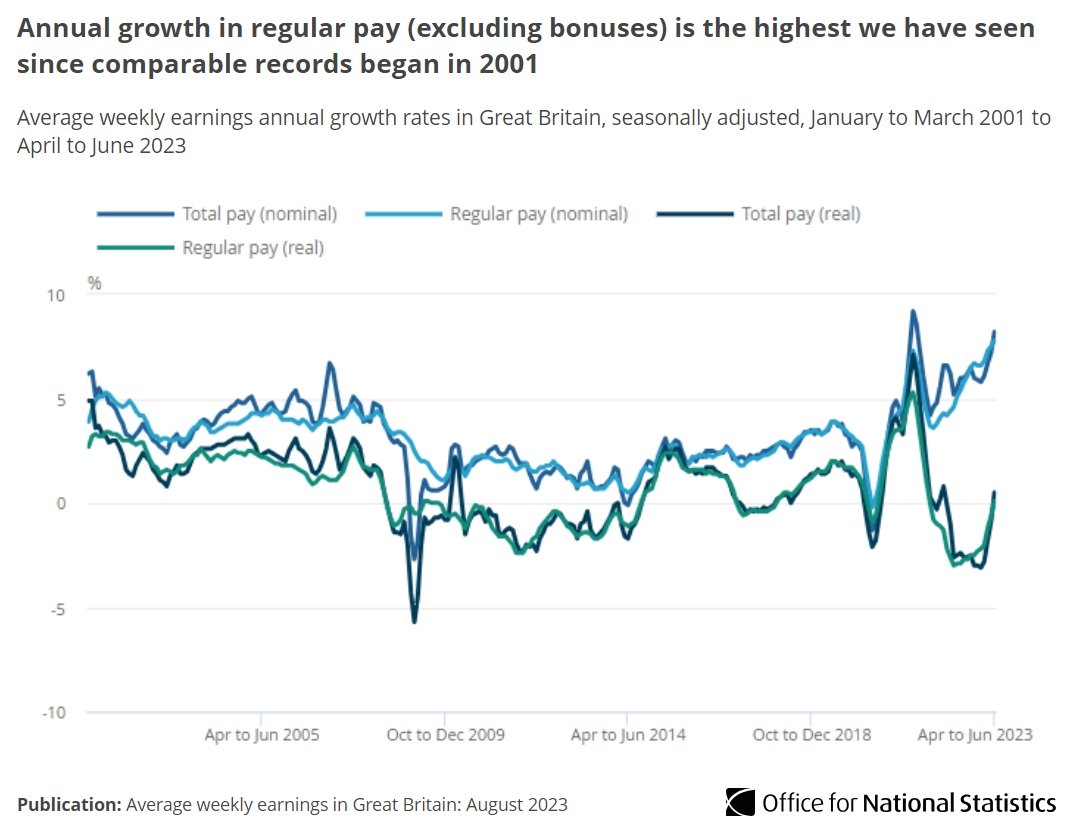

The annual growth in average pay including bonuses hit 8.2% in June, according to figures published this morning by the Office for National Statistics.

That could lead to next year’s state pension rise being 2% higher than expected, say experts.

Steve Webb, partner at LCP and former Pensions Minister, said: “It seems very likely that the pension rise implied by the triple lock policy will be much higher than expected at the time of the March 2023 Budget.

“Although inflation is coming down, the rate of average earnings growth has been heading upwards and is likely to be the key factor in determining next year’s state pension rise.”

He said an extra £2bn bill arising from higher-than-expected earnings growth seems quite plausible. He predicted that it would be unlikely that it would lead the government to break the triple lock in the run-up to a likely 2024 General Election.

When the state pension rate is set for April 2024, the rate of increase will depend on the highest of three numbers:

- The rise in average earnings (usually the three months May-July 2023 compared with the same three months in 2022); this statistic will be published in September 2023; this morning’s figure covers the three months April-June;

- The rate of CPI inflation (usually the September 2023 rate); this will be published in October 2023;

- A floor of 2.5% - which is expected to be irrelevant this year;

Helen Morrissey, head of retirement analysis at Hargreaves Lansdown, said: “Next month’s average wage figure is the one to keep an eye out for and we then have a wait until the September inflation figure is published in October before we know what the state pension under the triple lock will be.

“We may not see the eye-wateringly high increase in state pension that we saw last year - 10.1% - but something in the region of 7% is not out of the question.”

That would push up the full new state pension to more than £11,300 per year while if there were an increase of around 8.2% it would go up to around £11,470.

Steven Cameron, pensions director at Aegon, pointed out that the triple lock has come under intense scrutiny in recent years because of the volatility in earnings growth during the pandemic, and more recently because of sky-rocketing inflation, which reached double figures late in 2022 and has remained stubbornly high.

He said: “In April 2022, the Government suspended the earnings component because of furlough distortions, meaning state pensioners received an increase based on the previous September’s inflation of 3.1% which was around half the level inflation had risen to by April 2022.

“If earnings growth remains above price inflation in the coming months, state pensioners may be winners, particularly as they are less likely to be affected by rocketing mortgage costs and could also be benefitting from higher interest rates on cash savings.”