A new report has drilled down into the profitability and revenue streams of wealth managers.

Joint research from the British Bankers’ Association and the Wealth Management Association detailed profitability in the private banking and wealth management industry.

It is estimated to have generated a combined £1.54bn of pre-tax profit in 2016, up by 18% on the £1.31bn earned in 2015.

The report said: “While in aggregate the different firm types appear to deliver broadly stable profit margins over the past five years, these margins are estimated to have ranged from 19% for full service wealth managers to 44% for XO stockbrokers in 2016.”

The report is based on a survey of 13 CEO who run firms that manage and administer assets worth approximately £230 billion in the UK in 2016.

Private client investment managers are estimated to have generated £1.13bn in investment management fees in 2016.

The Wealth of Opportunities report stated: “This was by far their largest revenue stream, constituting 83% of their total revenue, and is a significant source of growth on the back of rising asset values.”

For full service wealth managers investment management fees represented 62% of their total revenue.

The report said: “This is only likely to increase as a proportion of revenue in the near future, bringing the revenue structure of these firms in line with investment managers.”

The researchers looked at revenue and said that when including all revenue streams and taking it as a proportion of average asset values throughout the year, private banks were the only firm type to be earning over 100bps on average, but this is significantly down on the 127bps earned in 2011.

Full service wealth managers and investment managers earned similar revenue return of approximately 70bps, whereas XO Stockbrokers had the lowest revenue return of 40bps, reflecting the non-managed nature of their assets.

Projected 2016 figures showed that private banks delivered the highest profit return on assets of 26bps in 2016, while the full service wealth managers achieved the lowest return at 12bps.

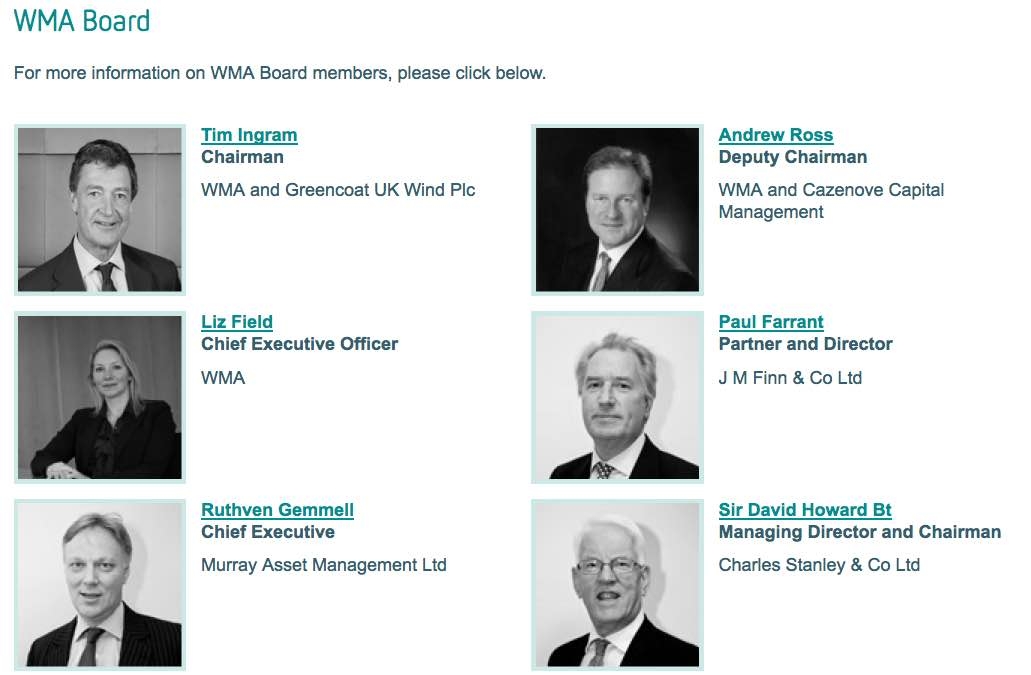

Liz Field, chief executive of the Wealth Management Association, said: “As well as making a sizeable economic contribution to the country, the PBWM sector remains committed to helping support individuals and families plan their financial future with confidence.

“As the impact of Brexit on the financial services industry becomes clearer, we remain committed to ensuring this success story continues.

“We are working with all stakeholders to ensure an orderly transition that protects clients from unintended consequences.

“Allowing the industry to continue to support individuals and families to better manage their savings and investments for the future remains our number one priority.”