Almost 100 per cent of high net worth individuals have trust and confidence in their financial adviser, according to a survey by Merrill Lynch and consulting group Capgemini.

Some 98 per cent of HNWI trusted their financial adviser and 88 per cent trusted their wealth management firm.

This is in contrast to the figures in 2008 when only 47 per cent of HNWI trusted their financial adviser and 48 per cent trusted their wealth management firm.

The figures were revealed today in the Merrill Lynch World Wealth Report.

But while confidence in advisers and firms has risen, levels of confidence in the markets have significantly dropped.

Only 57 per cent of HNWI trusted the financial markets and 44 per cent trusted the regulatory bodies.

This has fallen from 2008 when 68 per cent trusted the markets and 84 per cent trusted the regulatory bodies.

Despite this trust, HNWIs still remained cautious about their investments and held most of their assets in fixed income funds and cash.

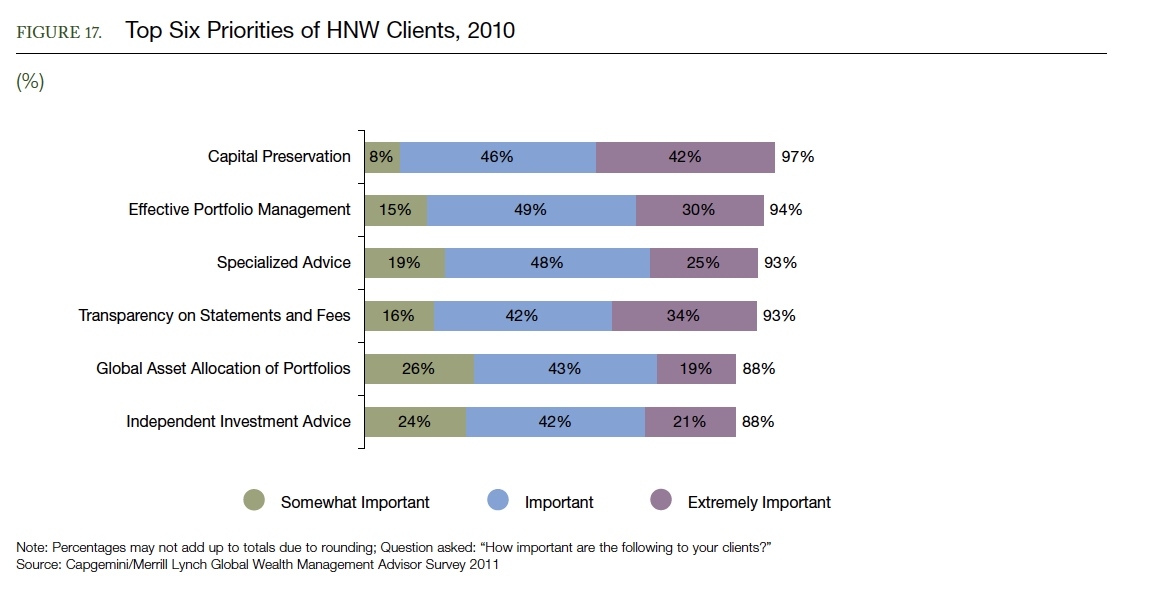

The priorties for HNWI were capital preservation and effective portfolio management. Some 97 per cent were concerned about preserving capital and 94 per cent wanted effective management of their portfolio.

They were most concerned about the economic impact on their goals and possible tax increases.

Alan Walker, head of financial services at Capgemini Consulting, said: “Amid this mixture of trust and misgivings among HNW investors, firms and advisers must continually demonstrate their value and relevance to help HNWI meet their changing and complex needs”