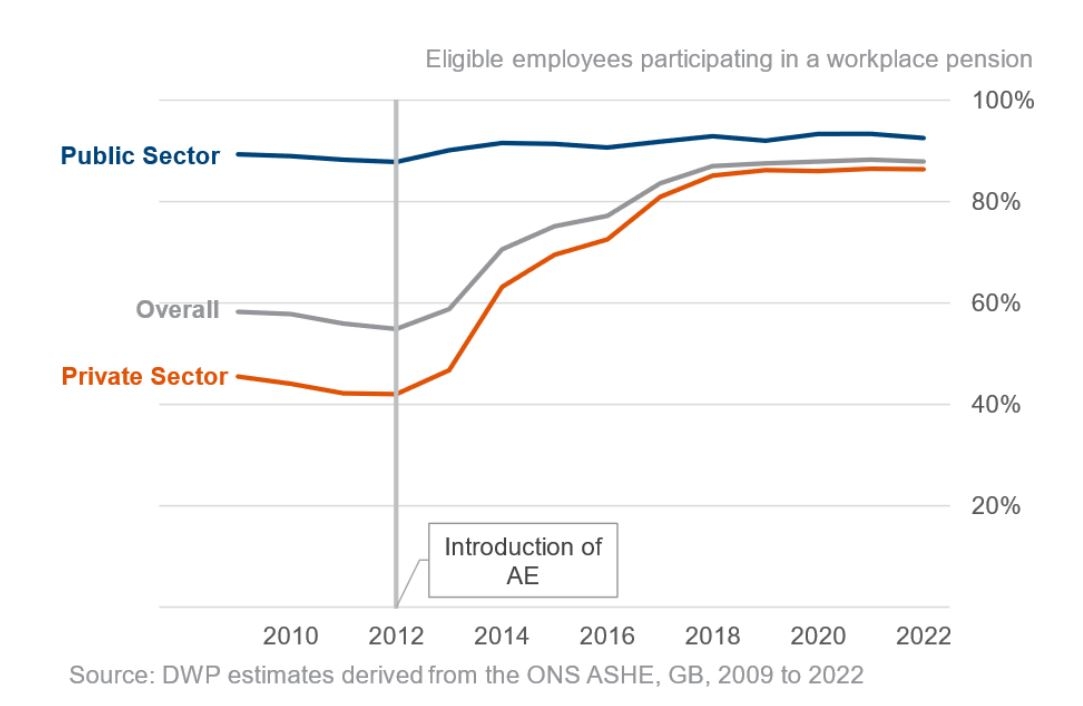

After years of sharp growth in participation during the roll-out of auto enrolment, workplace pension growth has stalled, according to new data from the Department for Work and Pensions.

Growth in workplace pension numbers began to slow as contributions have remained relatively stable since the start of the Coronavirus pandemic in 2020.

A total of 20.4m Britons were participating in a workplace pension in 2022, 88% of eligible employees, according to the DWP statistics. This compares to just 47% in 2012.

However, there were some gaps with relatively low participation for eligible employees in 2022. Only 59% of employees of micro employers were saving through workplace pensions.

There was also lower participation from some ethnic groups including below 75% participation for Pakistani and Bangladeshi, and Indian employees.

Total annual workplace pension savings for eligible savers was £115.9 billion in 2022. While this represented an increase in savings in cash terms from 2021 (around £1.2bn), when adjusted to 2022 earnings levels, this represents a real terms fall (around £5.6bn).

However, most workplace pension members were continuing to save, with less than 1% of members making an active decision to stop saving in 2022/23.

In the financial year 2022-23, the percentage of workplace pension savers stopping saving following an active decision to stop saving was around 0.8%; similar to last year at around 0.7%.

Auto enrolment was introduced in 2012 to help address the decline in private pension saving and to make long-term saving the norm. The roll-out was completed in April 2019.

In April 2019 the minimum contribution rates under AE increased from 4% to 6% of earnings within the qualifying earnings band including an increase in the minimum employer contribution from 1% to 2%. The latest DWP data showed that since the start of 2020, the proportion of employees contributing at least 6.5% of their earnings has largely stayed the same at around 46%.