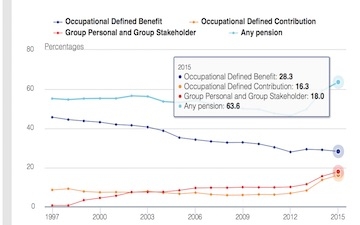

Workplace pension scheme membership has increased to 64% in 2015, the Office for National Statistics has revealed this morning.

A report has shown that it increased from 59% in 2014, caused by increases in membership of occupational defined contribution and group personal and group stakeholder schemes.

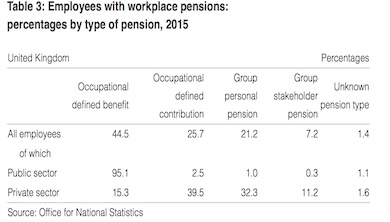

In 2015, 87% of employees in the public sector had a workplace pension compared with 55% of private sector employees, officials stated.

They said occupational defined benefit pensions schemes represented less than half (45%) of total workplace pension membership in 2015, down from a high of 83% in 1997.

Pension membership was found to have increased in most age groups in 2015 compared with 2014, with the largest increase (7 percentage points, to 61%) in the age group 22 to 29.

In the private sector, 40% of employees with workplace pensions made contributions of greater than zero but under 2% of pensionable earnings in 2015, compared with 33% of employees in 2014. The increase was likely to be driven by current minimum contribution levels for automatic enrolment, the ONS said.

Half of employees in the private sector received employer contributions of greater than zero and under 4% of pensionable earnings in 2015, compared with 43% in 2014. The increase may be explained by new members who have been automatically enrolled into a workplace pension with lower initial employer contributions until the phasing of contributions is completed in 2019.

In 2015, 64% of employees belonged to a workplace pension, the highest percentage since 1997 when the series began.

In 1997, 55% of employees belonged to a workplace pension scheme. In 2012, prior to the implementation of workplace pension reforms, 47% of employees belonged to a workplace pension scheme.

Membership of group personal and stakeholder pension schemes was 18% in 2015, compared with 16% in 2014.

Pension membership was highest in the age groups eligible for automatic enrolment - the 2 age groups not eligible (16 to 21 and 65 and over) had considerably lower membership.

Membership in the 16 to 21 age group was “particularly low” at 12%. Employees in this age band have not been eligible for automatic enrolment

Membership fell in the age groups around state pension age because many employees in these age groups were likely to be no longer contributing to pensions and may already be in receipt of private pensions, the ONS analysis stated.

The statistics were produced for the Annual Survey of Hours and Earnings report which is considered “a main source of information on workplace pensions in the UK as it collects information on all types of workplace pension”.