Newborns could be millionaires by the age of 43 thanks to an ISA.

That was the finding from Alliance Trust Savings, which has calculated the accumulative effect for parents saving for their babies.

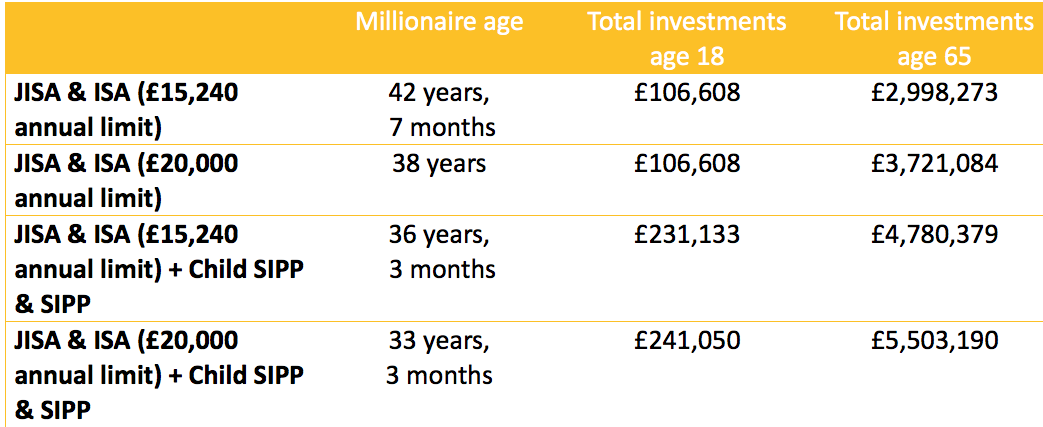

By contributing the current maximum allowance into a Junior ISA from birth and continuing to pay the maximum into adult ISAs, the report found that an investment pot could be worth more than £1million by time the child is 42 years and seven months, according to the company’s workings.

If the adult ISA allowance increases to £20,000 in 2017, as announced in the last Budget, today’s newborns could be ISA millionaires by the age of 38.

If they continued saving until age 65 they could have an investment pot worth nearly £3million at current maximum contribution levels, or almost £3.75 million with the £20,000 contribution limit.

If in addition to a JISA, parents paid into a Child Sipp from birth with maximum contributions of £300 per month, including 20 per cent tax relief, millionaire status could be achieved by 36 years and 3 months at current limits, Alliance researchers stated.

Using the £20,000 ISA limit and the same Sipp contributions, the child could reach one million at age 33 and 3 months.

The calculations use the platform’s current monthly ISA product charges of £3.33 until age 18 and £7.50 after 18 years old and current monthly SIPP product changes including VAT of £7.98 until age 18 and £18 after 18 years old.