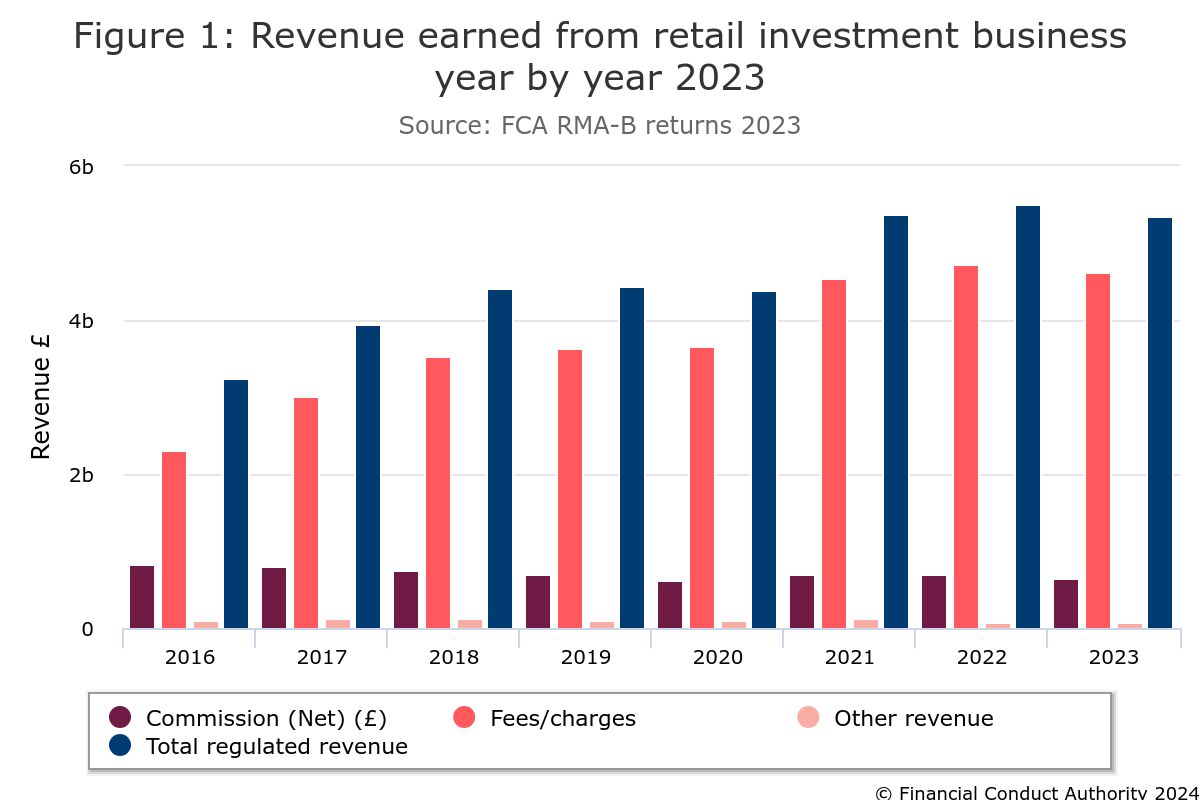

The amount of fee income and commission regulated IFA firms made last year both fell from record highs in 2022, according to new data published by the FCA.

The amount of fee income fell by £100m from a high of £6.7bn in 2022 to £6.6bn last year.

Over the same time period, the commissions made by regulated firms fell £55m from £714m to £659m. That meant total revenue for regulated firms fell 3% from £5.5bn to £5.3bn over the year to the end of 2023.

{Loadposition hidden2}

Looking further back through the figures reveals a continuing trend of commission taking up a smaller share of advisers' incomes.

IFA firms' revenue stood at £3.3bn in 2016, made up of £2.3bn from fees and charges and £844m from charges. That shows that while fee income has almost trebled in the last eight years, commission has fallen by more than a quarter.

The data also showed that the number of financial advisers fell by around 250 last year. The reported number of retail investment advisers working across all firms fell to 37,136 in 2023 compared to 37,381 in 2022.

The figures were published in the FCA's Retail Intermediary Market Data for 2023, which reports on firms that provide advice on, or arrange, mortgages, insurance policies or retail investment products for consumers.

Data showed that out of the firms providing retail investment advice in 2023, 86% were independent while 12% provided restricted advice. The percentage of all firms that provided both restricted and independent advice in 2023 was 2% compared to 1% in 2022.

The data reflects returns submitted to the FCA by firms for periods ending within 2023.