HMRC has warned users of its Self Assessment system to remain vigilant to scams that claim to be from the department.

Those earning over £100,000 could face paying over £7,000 in extra income tax if the current freeze on tax thresholds - due to end in 2028 - is extended to 2030, according to a new report.

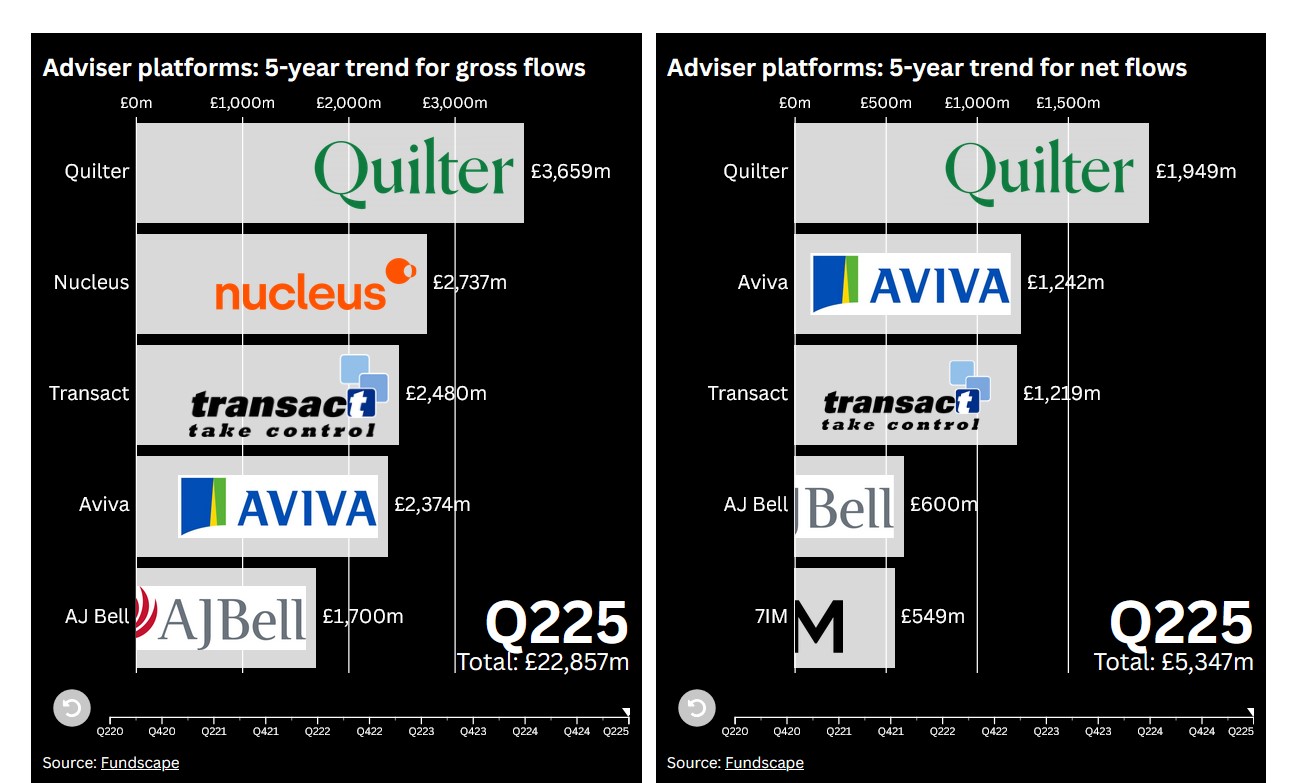

Aegon’s adviser platform saw a drop in net outflows to £1,447m in the first half of 2025.

The Society of Pension Professionals has called for pensions automatic enrolment to be extended to the self-employed.

HMRC collected inheritance tax (IHT) receipts of £3.1bn in the first four months of 2025/26, an increase of £229m (8%) compared to the same period in 2024/25 (£2.8bn).

Adviser platforms reported their strongest quarterly net sales figures in three years in the second quarter, according to new data.

Six people are to appear in court today over a pension fund and SIPP fraud which involved £75m being invested into storage units in the North of England and Scotland.

Hoxton Wealth has launched a three-year Financial Planning training programme called the Financial Planner Pathway.

675-member Waltham Forest Council Employee Credit Union Limited (FRN: 213408) has gone into administration and been declared in default by the Financial Services Compensation Scheme (FSCS).

Aberdeen has agreed to sell Aberdeen Financial Planning to Ascot Lloyd for an undisclosed sum.