New complaints received by the Financial Ombudsman Service (FOS) rose 20% year on year in between July and September, as Coronavirus pandemic-related gripes continue to rise.

The complaint uphold rate was 32%, no change from the previous quarter and four percentage points lower year on year. Excluding PPI, the uphold rate was 41%.

Complaints about credit cards saw a big increase. When compared to year on year, new complaints increased by 66%.

The ombudsman also saw in increase in the number of people approaching them who have fallen into financial difficulty as a result of the Coronavirus pandemic and were not happy with the way their lender responded.

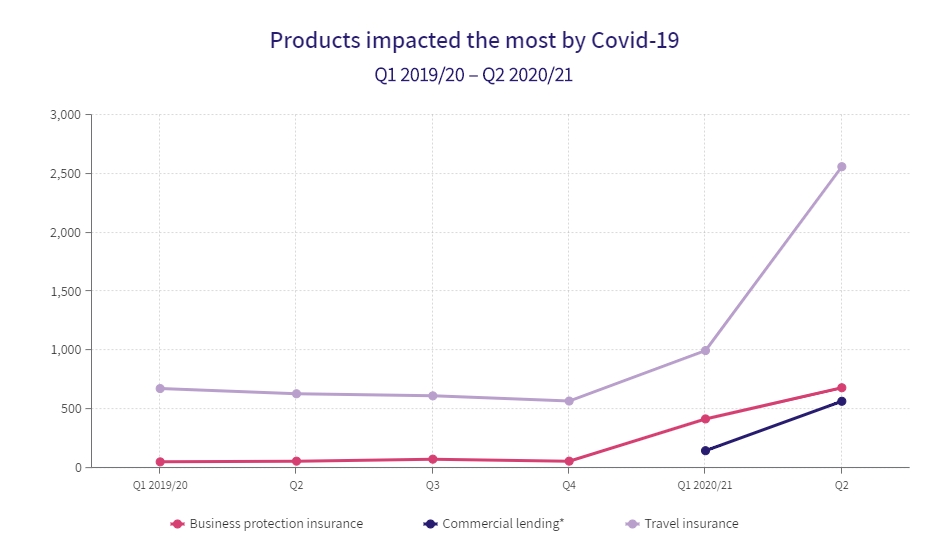

Complaints about travel insurance and business protection insurance also continued to rise considerably as a result of the pandemic.

The ombudsman also saw a rise in complaints in relation to the Coronavirus Business Interruption Loan Scheme (CBILS) and Bounce Back Loan Scheme (BBLS). Many of these complaints were from SMEs. It said it has now begun to resolve some of these complaints.

Total complaints from SMEs rose 201% from the previous quarter.

The FOS also saw a high level of claims management company (CMC) activity. Eight in 10 complaints about home credit were brought to it via a CMC, compared with an average of just three in ten across its wider caseload.