The Financial Ombudsman Service has so far received over 10,000 Covid-19-related complaints, according to its quarterly report out today.

The FOS received 5,900 complaints in its Q2 period (July to September) connected to Covid-19, pushing the total to over 10,000.

The FOS said: “Complaints arising from Covid-19 also continued to reach us, reflecting the wide-ranging impact of the pandemic on people’s lives.”

Some of the Covid-19 complaints relate to implementation of the Coronavirus Business Interruption Loan Scheme (CBILS) and Bounce Back Loan Scheme (BBLS). Many of these complaints were from SMEs.

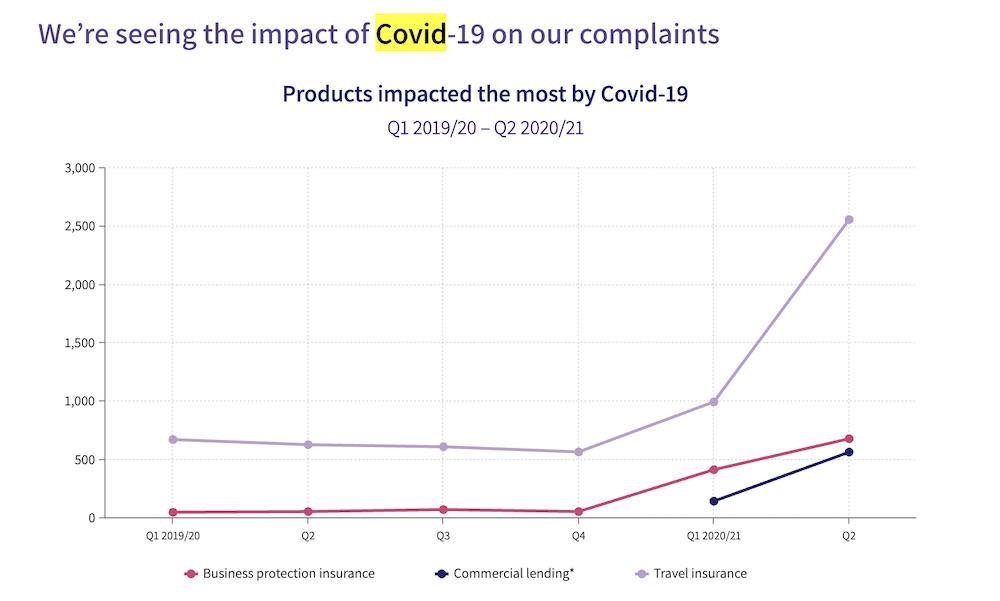

The biggest numbers of Covid-19-related complaints were connected to travel insurance and business protection insurance.

The FOS says it has begun to resolve some of the Covid-19 related complaints.

Overall the Financial Ombudsman Service upheld 32% of gripes in complainants favour in Q2. Excluding PPI, the uphold rate was 41%.

In the pensions area there were 821 new complaints about SIPPs with a complaint upheld rate of 57% (53% in Q1), one of the highest among all product areas. The second quarter saw a sharp rise in SIPP complaints from the 636 seen in Q1. The uphold rate for personal pensions in Q2 was only 27%.

There were 328 complaints about stocks and shares ISAs with an uphold rate of 27%.

Overall new complaints reached 68,735 in Q2, 19% higher than Q1 2020/21 and 20% higher than Q2 2019/20.

Referrals to an ombudsman were 9,204, 17% higher than Q1 2020/21 but 21% fewer than Q2 2019/20.

There were 391 new complaints from small and medium-sized enterprises, 201% more than Q1 2020/21 and 178% more than Q2 2019/20.

The FOS said it was seeing a high level of claims management company (CMC) activity. For example, eight in 10 complaints about home credit were brought to it via a CMC, compared with an average of just three in ten across its wider caseload.