Economic uncertainty caused people to cut back on spending by an average of £125 a month in 2018, a new survey has revealed.

The survey for Lloyds Bank, owner of Scottish Widows, found that 58% of people cut their spending in 2018.

People in the North West were the most frugal, with over two out of three cutting back in 2018.

Half of people expect to spend less in 2019, planning to save themselves £164 a month, although the number cutting spending is expected to fall compared to 2018.

Over half (58%) of people across the UK have saved £1,499 on their spending in 2018, according to the latest Lloyds Bank Spending Power Report.

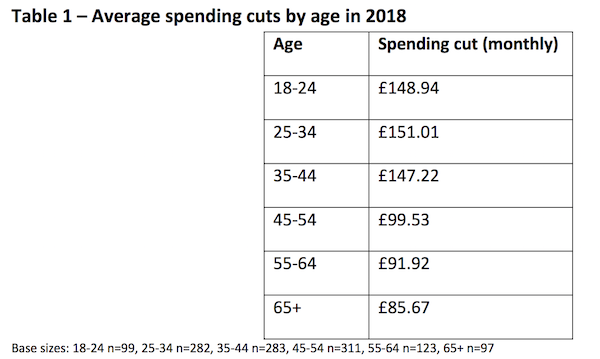

The report, which looked at how people changed their spending across the year, discovered that young people took the lead in tightening their purse strings with 61% of 18-34 year-olds changing spending behaviour to save money, compared to under half (47%) of those over 55.

Younger generations also managed to save the most on spending with 18 – 24 year-olds keeping back £149 a month.

The North West saw the largest proportion of spending savers across the UK, with more than two out of three (68%) taking action. Savvy regions also include the West Midlands (62%), Scotland and the South East (57%).

Those in Yorkshire and Humber cut back the least and were most willing to spend; with only half (51%) saying they had reduced their spending.

Londoners kept the most back, with savers claiming to put aside £172 per month.

Savvy spenders made have cut back on spontaneous purchases (64%) and grocery shopping (62%), the most common targets of spending reductions. Some 59% reduced the amount they spent on leisure activities.

Consumers also turned to coupons and loyalty discounts to help save money and nearly a quarter (23%) used savings websites to buy cut price goods.

Despite the looming concerns of Brexit, fewer people plan to cut back on their spending in 2019 compared to 2018, with only 50% believing they will take action to reduce spending, down from the 58% seen in 2018.

Robin Bulloch, managing director of Lloyds Bank, said: “Although 2018 has been a year of uncertainty for consumers across the UK, the majority are taking positive steps towards keeping back cash, showing that they recognise the need to take action and engage with their finances.”

The survey is carried out by Ipsos MORI on behalf of Lloyds Bank each month. Some 2,070 bank account holders were surveyed for this report in November.