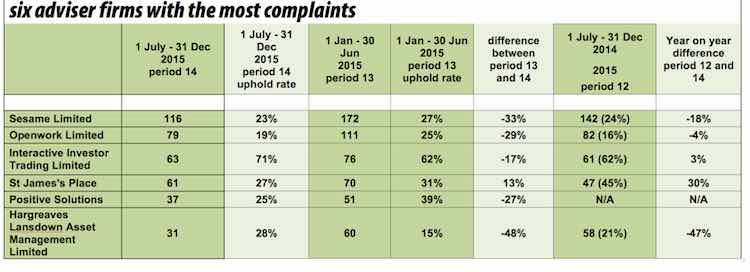

The advisory firm most complained about to the Financial Ombudsman Service for the last six months of 2015 was Sesame.

Despite a year on year decrease in complaints of 18%, there were still 116 complaints lodged against the company from July to December last year.

Second was Openwork (79 complaints), followed by Interactive Investor Trading (63) and St James’s Place (61).

Completing the top six were Positive Solutions (37) and Hargreaves Lansdown Asset Management (31).

Of these six firms, Interactive Investor was ahead by far when it came to uphold rate. Some 71% of cases were upheld against it, a rise from the previous half a year when it was 62%, though the number dropped from 76 to 63.

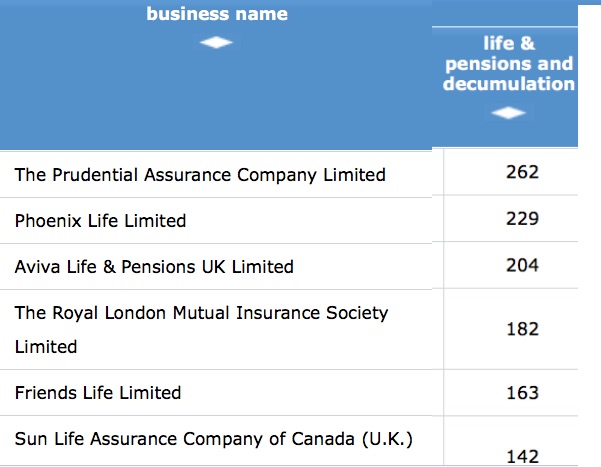

In the life and pensions and decumulation category, Prudential topped the most complaints with 262, followed by Phoenix Life on 229 and Aviva Life and Pensions UK on 204.

Royal London was fourth on 182, followed by Friends Life on 163 and Sun Life on 142.

In the category of investments, Lloyds bank was the most complained about firm with 233, ahead of second placed Barclays with 183 and Bank of Scotland with 155.

HSBC was fourth in this list with 143, before Natwest on 127 and Santander on 120.

Of the total cases referred to the ombudsman in the second half of 2015, payment protection insurance (PPI) made up 56% of new complaints – with 92,667 new PPI complaints, virtually on a par with the previous period (94,091).

The overall figures showed that the ombudsman took on a total of 164,347 new cases in the second half of 2015 – a slight decrease of 6% on the previous period.

For complaints about financial products other than PPI, the number decreased by 10% to 71,663. This reflects a downward trend in some areas such as packaged bank accounts, mortgages and pensions, as the end of the year approached.

The average uphold rate where the ombudsman found in the consumer’s favour over the six months was 53% – ranging from 5% to 97% across the individual businesses. 220 businesses feature in the data in total.

Chief ombudsman Caroline Wayman said: “The financial services sector has been through a challenging and volatile period in the eight years since the ombudsman first began to publish data about individual financial businesses.

“Though it still makes sense to plan for uncertainty and change ahead, the signs are that complaints are now broadly levelling off as we move onto a more even keel in the coming year.

“Complaints about PPI still continue to make up over half of our workload. During 2015, PPI complaints finally began to approach stable levels – but we’re still seeing the volume of cases at a much higher level than many people expected.

“There are many factors that can influence the complaints we see, from fluctuations in the stock market to extreme weather conditions - and more people knowing their rights when things go wrong.

“That’s why I believe it’s important that we continue to find new ways to work so we can resolve complaints quickly, while sharing our knowledge so businesses can avoid the ‘big claims issues’ of the past.”