The Chartered Insurance Institute (CII) has launched an investigation after a Kent financial advice firm run by a Chartered Financial Planner failed.

Financial services mutual Wesleyan has partnered with SS&C Technologies to launch its own digital-first wealth management platform.

A third (28%) of Generation X pension savers say they are confused by the financial information they are given about funding their retirement, a survey has found.

Close to two thirds (61%) of complaints to the Financial Ombudsman Service about advisers are related to advice suitability, according to a new study.

Half of advice firms are reviewing their client bases for potential segmentation ahead of the FCA’s Advice Guidance Boundary Review outcome, according to a new report.

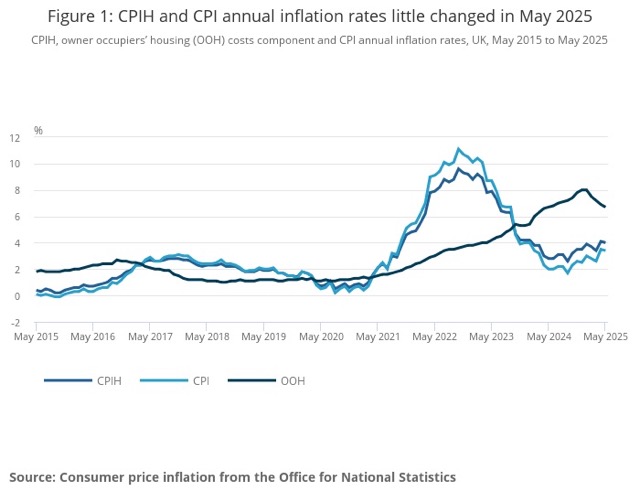

CPI inflation eased slightly in May to 3.4% from 3.5% in April, ONS said today.

One in five retail investors have switched money from equities to cash in response to stock market volatility, new research shows.

Fast-growing Financial Planning firm Shackleton, formerly the Skerritts Group, has been taken over by New York-based private equity firm Lee Equity Partners, which has taken a majority investment in the firm.

A new digital wealth app has been launched targeting six-figure earners who have outgrown basic financial products but do not have the millions needed to access private banks.

Simpler pension transfers took an average of just 11 days to complete in the lead up to the end of the 2024/25 tax year.