The proportion of complaints about advisers, which were upheld by the Financial Ombudsman Service, has fallen in the last year.

In the organisation's annual review, published this morning, it showed that 39% of complaints against IFAs were upheld, compared to 42% the previous year.

The volume of complaints decreased. There were 2,875 complaints against IFAs received in the 12 months to the end of March, as against 3,599 over the same period last year.

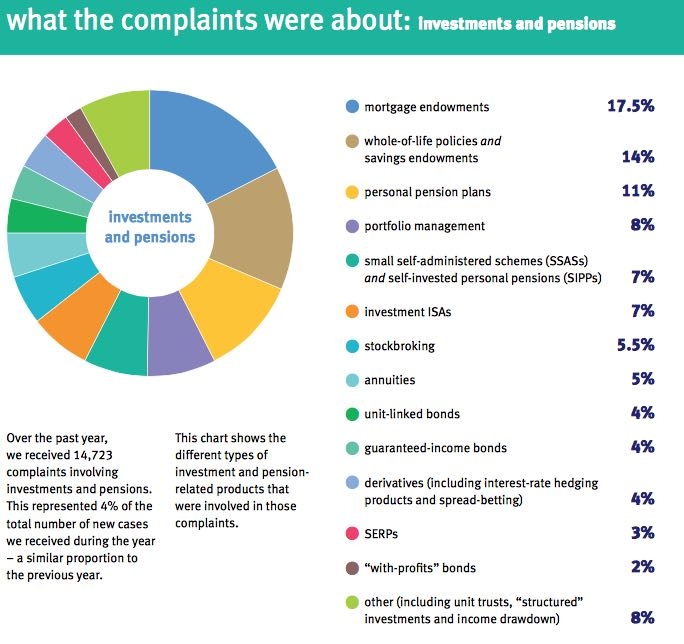

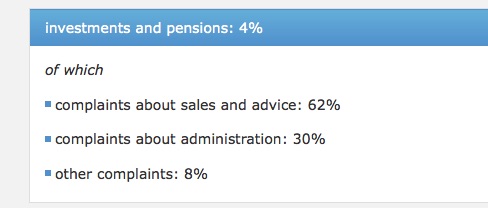

Investments and pensions represented a total of 4% of complaints in 2015 – that was 14,723 cases, compared to 3% and 15,938 in 2014.

{desktop}{/desktop}{mobile}{/mobile}

The number of complaints about pensions was 4,290 in the 12 months to March 2015, down by 2%.

Last year there were 4,361, which was a decrease itself of 1% on the 4,401 cases in the year before that.

Out of these pension complaints there were 776 on annuities, compared to 601 the previous year.

The FOS report said on this: "Despite receiving fewer complaints about pensions overall, we received 29% more complaints about annuities. Annuities received a large amount of publicity during the year, mostly around the changes from April 2015 that mean people no longer have to buy them.

"Many people we heard from were unhappy about being offered a much smaller annuity than they'd expected."

Personal pension plans accounted for the biggest chunk of new pension cases with 1,618 cases, but this was down from 1,748.

The FOS said it found that complaints involving pensions and investments were far more likely to require an ombudsman's decision.

The report said: "These complaints often involve very large sums of money – and people's financial security can depend on the outcome. So it's understandable that people may want to pursue these types of complaints as far as they can."

In terms of new cases involving financial products other than PPI, pensions made up 3.5% while savings accounts represented 2%.

The number of new cases about investment ISAs was up 8% from 929 in 2013/14 to 1,006 in 2014/15, while there was a 32% rise for guaranteed income bonds, up to 555.

There were fewer new cases about savings accounts – down 17% from 3,611 to 2,989.

Today's report also coincided with the 15th anniversary of FOS.

Chief ombudsman Caroline Wayman said: "The world has moved on and changed significantly since I first joined the ombudsman as an adjudicator in 2001. Yet our workload over the last 15 years has been constantly dominated by the past – clearing up the fall-out of the mass claims and mis-selling scandals of the last decade and a half.

"It's so important that lessons are learned from what's gone wrong in the past – to prevent yesterday's problems from becoming tomorrow's complaints – and to help ensure financial services evolve to meet the needs of today's customers."

Statistics from this year's annual review showed:

· Since 2001 the ombudsman has received 2.8 million complaints of which 1.3 million have been about PPI.

· During 2014/2015 one in five initial enquiries turned into a formal dispute – a total of 329,509 new complaints.

· 55% of the cases resolved in 2014/2015 were found in the consumer's favour.

· Payment protection insurance (PPI) still made up two thirds of the ombudsman's workload in 2014/2015, despite the number of PPI complaints halving to 204,943, from the record highs in 2013/14.

· During 2014/2015 the ombudsman settled 448,387 disputes about an array of financial products from annuities to warranties.

· During 2014/2015 we resolved one in five payday lending complaints using only our webchat service.

· Four of the UK's largest banking groups accounted for 58% of all complaints received.

· People from Bolton were the most likely to phone FOS and consumers from the North East more likely to complain about PPI.